Adoption of blockchain technology continues to accelerate into 2021, driven in part by cryptocurrencies like bitcoin, but increasingly by investments across a wide range of financial services for a variety of use cases.

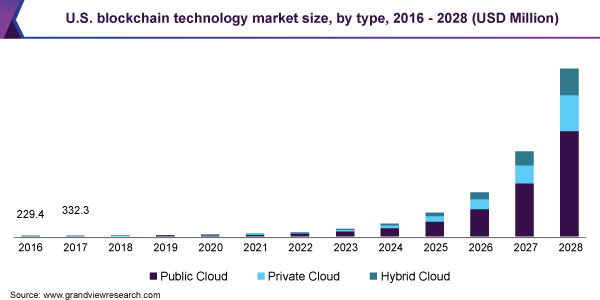

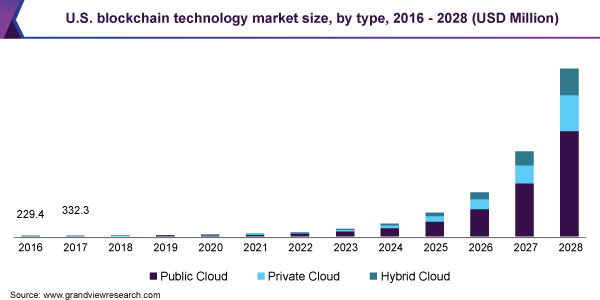

According to the recently released Blockchain Technology Market Size report from Grandview Research, the blockchain market was valued at $3.67 billion for 2020, but rapid expansion is expected: an increase in compound annual growth rate of 82.4% for 2021-28.

Blockchain has a lot of promise for the financial sector: as an open, immutable ledger it offers increased transaction security, and as commercial and central banks across the world begin to adopt the technology for payment processing – including, in some cases, increased acceptance of cryptocurrencies – the promise for less expensive, faster payments is alluring for many players entering the market.

That topic was a part of the discussion at the March 9 Huawei Cloud Day event held by Singapore-based FinTech Morpheus Labs.

“Banks in the more traditional sense, particularly in the physical sense, are becoming less and less relevant as we go forward,” said Greg Unsworth, Risk Assurance and Digital Business Leader with PwC Singapore. “But as we look at banking as a range of services that are going to be important for consumers, businesses, and society, the importance of banking will only increase. These more sophisticated technologies are necessary to address more sophisticated needs.”

Blockchain technology in banking can be a major piece of that puzzle as services fully embrace digital transformation. That process will still take time, but the promise has only become clearer as consumer habits continue to rapidly shift towards digital-only solutions.

“I would say blockchain has not yet been widely adopted in a wholesale model,” Unsworth said. “But the potential there is significant. We see more and more applications for blockchain technology being developed.”

Those opportunities are real, and the savings could be enormous for institutions that take the right steps for adoption. According to a February report from CB Insights, moving securities over blockchain could save $17 billion to $24 billion annually in global trade processing costs. The potential in KYC is a similarly big potential for cost savings, possibly bringing down costs by $160 million annually.

KYC is a particularly large point. As new technologies are adopted, compliance continues to become more complex even as the demands for settling those transactions push for accelerated speeds.

“This is going to get more complex with new technologies,” Unsworth said. “We’re seeing regulators step out to address digital-related risks. Striking the balance between trusted ecosystems that also protect consumers in the right way is quite key – even just keeping pace with that change as newer models come on.”

Adoption in this sector is only going to accelerate as the market grows, as blockchain can solve a number of the issues posed by an increasingly-digital payments model. Digital payments rely on multiple parties to process transactions, and the reliability of digital identity – a foundational piece of blockchain – is key to speeding that process.

“The fintech revolution demands a need to evolve these services in consumer-friendly ways,” Unsworth said. “That is actually creating a lot more competition and a lot of pressure on the banks to continue evolving their business models. We’re also seeing a lot of new entrants coming in.”