Emerging markets stand on the brink of a transformative year in 2024, propelled by remarkable strides in financial technology, as per an April FT Partners report. These regions – increasingly embracing digital banking, alternative lending, and blockchain innovations – are anticipated to see a significant uptick in FinTech investments. By harnessing technology to bridge gaps in … [Read more...] about Fintech Rising Weekly: Emerging Markets Set for 2024 FinTech Boom

fintech

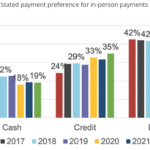

Fintech Rising Weekly: Focus on Payments Growth

This week, we dive into the Federal Reserve's 2023 Diary of Consumer Payment Choice, highlighting the continued dominance of credit cards and the stabilization of cash usage. Additionally, we cover Apple's concessions in the EU Tap-to-Pay dispute, growth in both U.S. realtime payments networks, and new guidelines from China on payment services for foreigners, and more insights … [Read more...] about Fintech Rising Weekly: Focus on Payments Growth

Fintech Rising Weekly: Focus on Faster Payments

As part of our commitment to providing relevant payments and FinTech news and analysis, we're excited to announce our new weekly report. Each week, we’ll highlight some of the most interesting and relevant articles in the industry. This week, we’re highlighting recent payments reports. From the transformative power of real-time payments to the potential of tokenized deposits … [Read more...] about Fintech Rising Weekly: Focus on Faster Payments

Transforming Fintech: Insights from Industry Leaders on Innovation and Impact

At a recent event hosted by 1871, industry leaders gathered to share critical insights into the future of fintech, emphasizing the importance of innovation, collaboration, and responsible practices. The discussions highlighted emerging trends, challenges, and opportunities within the fintech sector, particularly in the Midwest. Of particular note was a discussion on the need … [Read more...] about Transforming Fintech: Insights from Industry Leaders on Innovation and Impact

Embedded Finance: A Paradigm Shift in Financial Services

Embedded finance - the seamless integration of financial services into non-financial digital environments - is revolutionizing the way businesses and consumers interact with financial products. Once in the sole provenance of traditional financial institutions, these services are now being woven into the very fabric of digital commerce, from shopping platforms to social media … [Read more...] about Embedded Finance: A Paradigm Shift in Financial Services

AI Unleashed: Remapping Fintech’s Future

As the FinTech industry strides through 2024, it finds itself at the heart of a technological revolution with Artificial Intelligence (AI) beginning to stand out as one of the drivers on the charge. This era of innovation is remapping the contours of financial services, making operations more efficient, enhancing security measures, and personalizing customer experiences. The … [Read more...] about AI Unleashed: Remapping Fintech’s Future