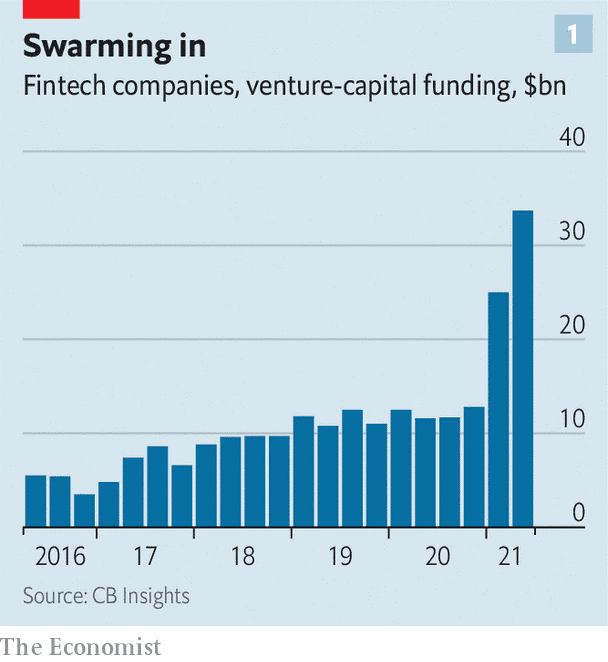

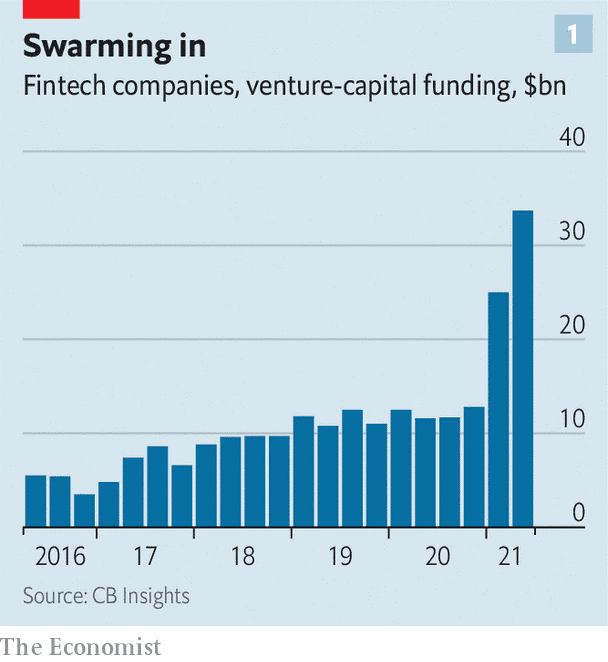

There’s a lot of investment money sloshing around the economy these days, and a record amount is flowing into FinTech projects this year. Most of the data and investment research firms, as well as the FinTech investment banks, suggest that FinTech is well on its way to a record investment year.

Some $34 billion flowed into FinTech in Q2, a quarterly record, according to CB Insights, a data firm. FinTech investment in the UK and Europe are following similar trends, reports Innovate Finance. UK FinTechs have raised $5.7 billion so far this year, beating 2020’s total.

About 20% of all venture capital money washed into FinTech firms, this year, The Economist reports in its FinTech investment roundup. Investors are on the “hunt for juicy returns as the digital surge in finance takes off.” After detailing a number of the deals done by large banks and card issuers, the publication notes the “something more profound” is going on: “FinTech firms are becoming part of the establishment.”

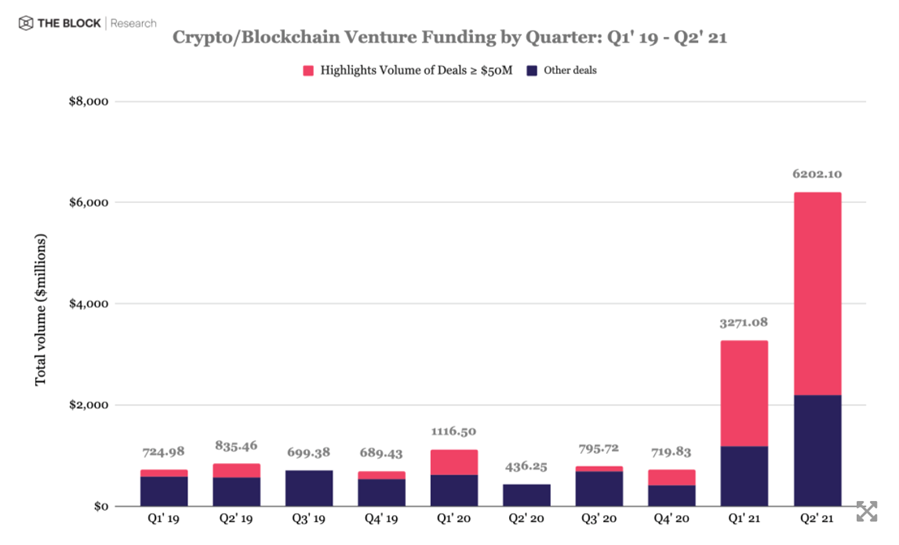

Money is streaming into all fintech sectors. Payments leads but wealth, insurance, and lending FinTechs have raised their share. The more cutting-edge crypto firms also saw record investment surges.

For decentralized finance protocols, Q2 2021 saw a continuation of crypto moving into their liquidity pools “with most metrics reaching new all-time highs mid-way through the quarter,” reports Messari, a crypto data and research firm

These projects may not be mainstream yet but they are following mainstream FinTech trends. “The amount of venture funding directed toward crypto and blockchain projects and companies jumped during the second quarter of 2021,” according to data collected by The Block Research.