The payments industry is currently undergoing a once-in-a-generation change in infrastructure, as use cases increasingly shift towards the promise of faster, or even instant, payments settlement.

Progress has been ongoing for years, but the reality of the global pandemic drove the reasons for innovation to the forefront of the minds of many in businesses from small to large today. That increasingly urgent perspective was a key theme revealed by the Federal Reserve’s recent Market Readiness Brief survey, which collected responses from more than 2,000 businesses ranging from small to very large.

Looking at a range of different industries and specialties, the survey ranged from answers both common sense and surprising on topics from interest in specific use cases to addressing pain points currently present in the marketplace.

The impact of Covid-19 is impossible not to feel in some of the answers; the strong focus on managing cashflow is no surprise. Making payments operations more efficient has been a key point for many businesses that have struggled through the crisis, and having immediate remittance and reconciliation options for activities from payroll to regular invoicing ranks high on wish lists across multiple industries.

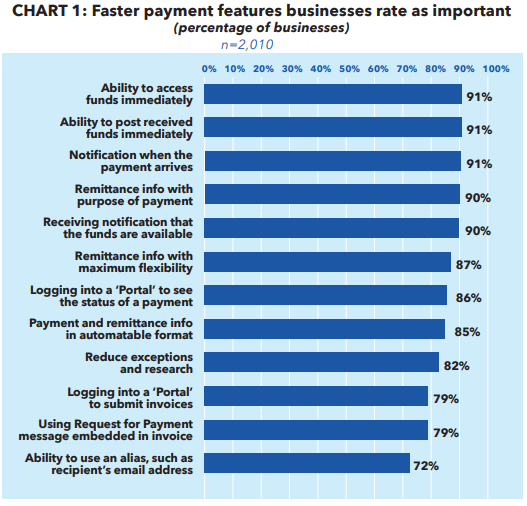

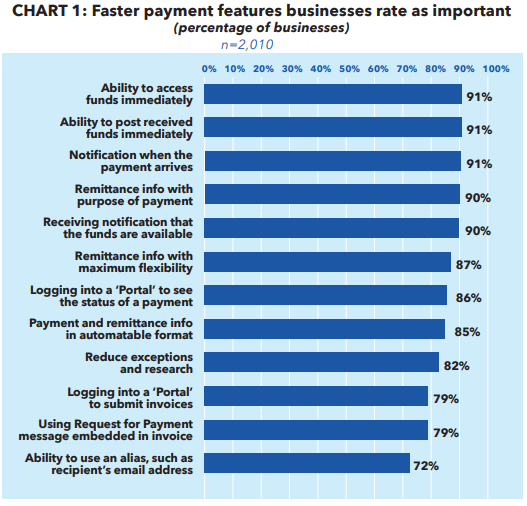

Most businesses across the board agreed that enhanced remittance information, immediate posting and reconciliation – preferably in an automatable form – and easier invoicing ranked at the top of the list for important capabilities.

More surprising was the higher level of willingness among larger businesses to adapt to newer faster payments systems. Inertia is often thought to trump everything else when it comes to big business – and indeed, there are responses to suggest that legacy systems are still sufficient for now – but the appeal of the transformative use cases available under faster payments systems seem to be overtaking all other concerns on the higher end of the revenue scale.

For smaller businesses, there was more reticence – which may seem surprising at first blush, but makes sense when considering how small business owners manage their finances, with a much heavier reliance on third party suppliers like Quickbooks for management options. For these businesses, adoption will rely on these third-party companies making the leap for them; it’s out of their hands.

And business is optimistic about the timeline – 9 in 10 surveyed expect to be able to initiate faster payments on a broad scale by 2023. And no surprise, there – a large majority have already made some use of existing faster payment models within the last 12 months, with larger businesses taking the lead on this metric as well.

Half of those surveyed offered an even more aggressive timeline for moving forward to making the switch, suggesting they would need less than a year to support 24x7x365 payment operations once they decide to adopt faster payments or use them more extensively.

All of it marks one clear message: times are changing quickly, and the payments landscape just a few years from today is likely to look very different than even where it is today.