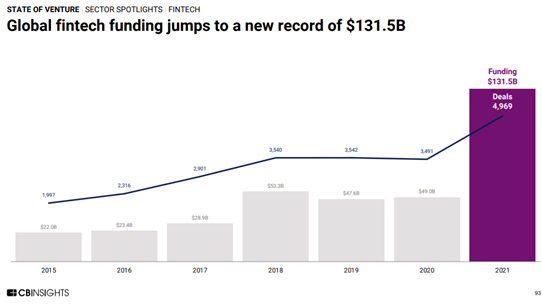

FinTech investments surpassed every year prior in 2021 – $131.5 billion.

That’s more than double 2020’s final tally, and 2020 had already set records for that year. It is safe to say that FinTech’s moment has arrived. The digital transformation of finance hit a transition point to become an integral part of business as usual for financial services across the board.

In December 2021, we asked you for your thoughts on the biggest trends in this new phase of FinTech for the coming year. Your answers pointed clearly to a 2022 in which digital technologies will continue to transform all aspects of not only payments, but of how we look at the digital space in general. Here are some of our thoughts on what our readers noted to expect.

Digital assets and blockchain technologies will continue to dominate the conversation.

It’s been a year of wild growth for crypto and blockchain technology in general. Despite the ups and downs that characterize the currency, bitcoin has seen roughly 57% growth in value since January 2020, according to a report by bitcoin technology firm NYDIG. 2021 also saw a tide of new, institutional investors from some of the more conservative parts of the investing world.

And as bitcoin becomes increasingly respectable, the frontiers continue to expand outward – NFTs, DeFi, and a host of other wild new blockchain-driven ideas have already made huge strides. We expect that conversation will only continue to accelerate into 2022, as innovators continue to push the boundaries on what can be done with decentralized technologies.

Those FinTech drivers aren’t working alone anymore, either; institutions are embracing this digital revolution, with mergers, acquisitions, and partnerships driving a massive push for legacy banks and investment firms to keep on pace with their digital challengers.

The professionals that support deal-making report that they did more deals than usual in 2021. Venture capital and private equity firms remain under pressure from their partners to invest their available cash. Competition for deals remains high. FinTech investment levels are expected to remain high as a result.

Faster Payments remain the most promising payments use case for 2022.

Realtime payments have continued to surge, as the promise of a faster alternative to the aging ACH system continues to move from theoretical to reality for actors all over the industry. While we’re all still waiting on FedNow – and will continue to in 2022, as the Fed has committed to a 2023 rollout – other realtime payment systems in the market report increasing adoption. And new players like RealNet trying to make their mark on the space while there’s still time to get involved.

For 2022, expect the conversation to shift toward a customer focus as institutions formulate plans for wider adoption – and the many ways that could fundamentally alter our economy.

In the current marketplace, some studies estimate that nearly half of all B2B invoices are paid late – some by a month or more. It’s one area where real-time payments could be absolutely transformative, especially as current issues with the supply chain seem likely to continue well into the future. Being able to monetize relationships with suppliers with snap payments could fundamentally transform the way we do business while allowing for greater flexibility in the face of uncertainty.

As one of our respondents put it, “Payment and real-time processing are going to become the holy grail as the banking sector invests to get ahead of the situation. They cannot allow nimble startups to eat their bread-and-butter profit areas.”

ESG becomes the gold standard in investing.

ESG-focused funds have been around for years, but for a long time languished under a perception that they were poor performers compared to more traditionally focused investment strategies. That all changed with the pandemic; large funds with environmental, social, and governance criteria are starting to outperform the wider market, making it a win-win for investors who care about what their money’s supporting.

Driving this change in part may be the increasingly strong data tools for measuring sustainability and other metrics with increasing accuracy, giving thematic funds more insight into what those investments are accomplishing. Regulatory interest, too, will likely continue to fuel this space going forward; the United States has signaled a renewed interest in the global climate agenda over the past year, and regulatory action both here and abroad in Europe will likely continue to translate into sustainability as a clear marker for market winners and losers.

All of this reflects in the clear, explosive growth in ESG investment. As Morningstar shows, it’s a growth trend we think marks a clear shift to a new baseline standard for all investing.

Sustainable funds globally Sustainable funds in Europe

Source: Morningstar Direct Manager Research, September 2021.

NFTs take center stage.

They looked to be a bubble at the beginning of 2021, but for better or worse, nonfungible tokens seem to be here to stay. Industries from all over the sphere of the burgeoning web3 movement have started to look into ways to transform the token from a means to invest in bored apes to a signifier of real digital ownership.

Huge investments in the business sector – from AAA game publishers like Ubisoft and Square Enix signaling blockchain interest to their investors for NFT-based gaming – to a lot of talk about the “metaverse” and a decentralized web for everything from images to music from the likes of Apple, Facebook, and Block (formerly Square) clearly position NFTs as an investment that will almost certainly continue to heat up throughout 2022.

And that’s without even looking at their continued potential to revive the digital art market and offer new ways for creators online to monetize their work through concepts like fractionalization that were simply not possible before blockchain technologies.

Problems remain, certainly. Transaction fees for ethereum, the cryptocurrency that supports many NFTs, remain high, and there’s a clear need for a shift to a newer standard of ethereum or another sidechain to bring down extremely energy-inefficient practices. Yet the idea of digital provenance is one of the most important pieces of the digital transformation puzzle, as it could finally bring the concept of ownership into a space that has long resisted such.

Stormy seas ahead.

Despite the vast digital potential for FinTech in 2022, there’s still a lot of headwinds to be concerned about going forward. Global supply chain disruptions are a problem that’s not likely to solve itself anytime soon, and higher rates of inflation will likely continue to be disruptive in ways that the U.S. hasn’t had to contend with since the early 70s.

The maturation of the digital assets, too, comes with the increased push for regulation, and while those moves are necessary to really mainstream the space, concerns that the government may make the wrong moves – or continue to fundamentally misunderstand the promise of these technologies – is something all institutions will have to continue to bear in mind as they make their plans.

Ultimately, though, it’s a bright picture for the FinTech companies that continue to disrupt the market. They can’t all be winners, but the biggest trend for 2022 will be one of ubiquity – all institutions are realizing they need to be FinTech companies to continue to compete, and those that adapt best to these new technologies are going to be the big winners in the evolving marketplace.