The digital era continues to redefine industries, propelling the payment sector to the forefront of this transformation. Both consumers and businesses, driven by the pressing need for speed and convenience, have been gravitating towards faster and real-time payment mechanisms.

Same Day ACH: Meeting the Urgency

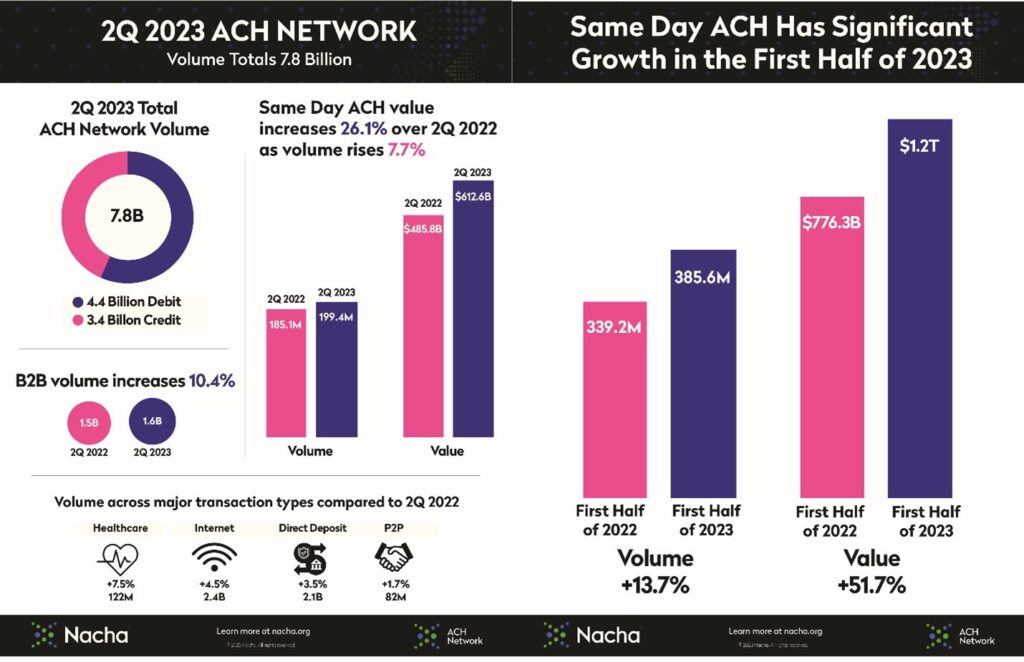

As an embodiment of this demand for swiftness, the growth of Same Day ACH stands out. Although founded on the already established ACH infrastructure, it has been revamped to cater to the modern market’s urgency. The augmented volume and value, coupled with extensions in operating hours and the higher per-payment limit, is a testament to America’s fast-paced payment aspirations.

Volume continues to steadily increase year-over-year, and though adoption rates have slowed over the last few years, transfer value continues to skyrocket:

Real-Time Payments: A Competitive Landscape

Within the evolving landscape of real-time payments, a notable competition is unfolding between the Clearing House’s RTP network, introduced in 2017, and the recently launched FedNow. The RTP network, given its earlier inception, has had the opportunity to solidify its infrastructure, ensuring reliability and effective governance over time. This longevity provides it with inherent advantages that often accompany established systems in terms of stability and user trust.

On the other hand, FedNow, although a newcomer, is anchored by the significant endorsement of the Federal Reserve. This backing not only lends immediate credibility to the platform but also underscores its potential to introduce meaningful innovations in the sector. Of particular interest is FedNow’s mission to make real-time payments accessible to a broader spectrum of financial institutions, especially those that are smaller in scale.

The RTP network, in the meantime, is seeing steadily increasing volume.

P2P Platforms: Beyond Traditional Boundaries

The momentum isn’t restricted to institutional advancements; P2P platforms have also been part of this monumental shift. Platforms like Zelle, Venmo, and PayPal have not only seen significant adoption rates but have also evolved beyond their traditional remits. Their integration into businesses and varying transaction values underscores their adaptability and expansive potential.

Zelle, Venmo, and PayPal: Comparative Dynamics

Zelle: Predominantly integrated with financial institutions, Zelle’s 2022 data showcases 2.3 billion processed payments, worth $629 billion. Interestingly, Zelle’s user engagement has led to heightened interaction with their checking accounts.

While Zelle has a smaller user amount compared to competitor Venmo, it processes by far the largest dollar amount of any of the Peer-to-Peer payments services. Despite being a relative newcomer to the payments space, Zelle reports more than $1.5 trillion in payments since its launch in 2017, and is projected to reach 63.7 million users in 2023.

Venmo: Venmo’s journey from its 2009 inception to its acquisition by PayPal speaks volumes about its significance. Processing $244 billion in transactions in 2022, it catered to over 78 million users, primarily in the U.S.

PayPal: Still one of the juggernauts in this space, with a 23 year history that makes it ancient in P2P payments, PayPal reported a Total Payment Volume of $376.5 billion in Q2 2023, with net revenues of $7.3 billion. Its vast ecosystem, with 431 million active accounts, continues to make it a key player in the digital payments sector.

While Zelle’s embrace by numerous banks showcases its stronghold, Venmo’s social features make it a favorite among younger demographics. Meanwhile, PayPal’s expansive ecosystem and robust financial metrics underline its continued market dominance.

Future Outlook: The Payment Renaissance

Gazing ahead, the payment industry is on the brink of a revolutionary era. With the rise of faster payment solutions, players like Zelle, Venmo, and PayPal are not just part of the narrative—they are shaping it. The evolving metrics suggest a more profound shift, one that aligns with the instantaneous demands of the present day.

The drive towards faster payments isn’t merely about speed—it’s about revolutionizing the way we perceive and conduct financial exchanges in the digital age.