Much of my knowledge of payments comes from my daily experience. Like many consumers, I want things that work without me thinking about them. This year, I’m very much down with the increasing prevalence of contactless cards and anything that integrates digital wallets (cards on my phone) with POS and web payments. My list includes payment systems that reduced friction in the process, plus a wild ride into the dark side of the payments business.

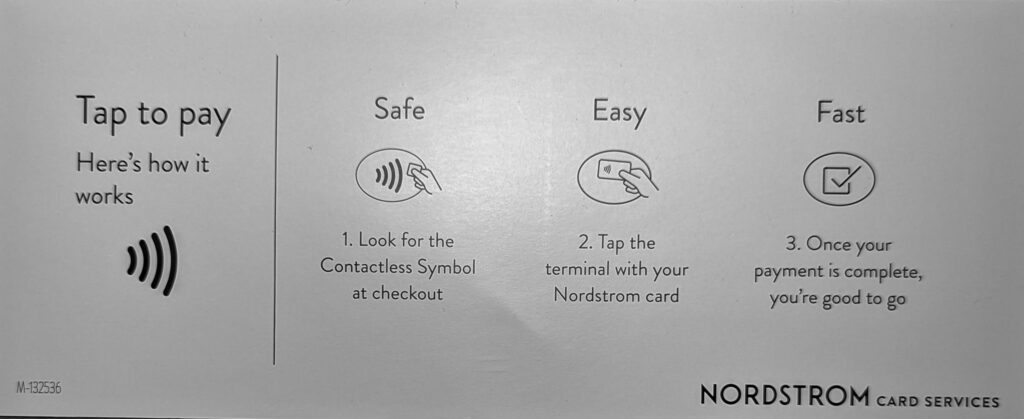

1 Contactless Payments. I never especially adopted mobile payments, for instance, because I found using my phone was harder than cash or a card. I wait impatiently for people to scan their mobiles when a tap of the card is so much faster. Contactless payments aren’t new, but I noticed a lot more POS devices supported them this year. I imagine card transactions have increased as a result, especially given the card advertising I’ve seen.

2 Money Men. This is a book, not a payment mechanism, but it underlies the primary problem with payments: fraud. Money Men is Financial Times reporter Dan McCrumb’s chronicle of his investigative reporting on the Wirecard fraud, a story that continues. It’s a fantastic yarn about the complexity of payments and how it covered up financial deception and international spying. “The complexity was part of the cheat,” he said. “They hid behind it.” McCumb gave the keynote at the 2023 Midwest Acquirers Association conference. Watch the Netflix drama, “Skandal! Bringing Down Wirecard,” for a taste of it.

3 Uniqlo Check Out. I’ve used their payments system several times over the last few years, which still amazes me. You dump your merchandise in a bin and see the total on the POS device, all through individual RF tags on each thing you buy. The Wall Street Journal called it “The Self-Checkout Event Haters Will Love.”

4 Mobile POS/Scan to Pay. These are not new technologies, either. I first experienced them on a trip to Europe maybe a decade ago. One of the farmers at the market I frequent started using mobile POS several years ago. This year I increasingly saw both mobile POS and QR-based scan to pay at the table in restaurants, including a large device that the Chili’s server put on the table and left. All very convenient, especially the Chicago parking lot where you an scan the code and walk to your car to enter the license plate on the page.

5 FedNow Launch. It was a major milestone for the United States Federal Reserve to launch a new payment system following the rollout of ACH in 1976. FedNow reports more than 300 financial institutions signed on at year-end. Many of the same dynamics of a public institution competing with private banks remain, and the shift to instant payment settlement could make it less expensive for consumers to pay. Our overview on faster payments, including U.S. options for instant payments, is available in our executive technology brief, Faster Payments for Faster Times.