The pace of innovation in fintech is accelerating, with new developments in stablecoins, cloud computing, and regulatory frameworks continually reshaping the industry. As we track these shifts, let’s revisit our recent insights and see how the landscape has evolved in just a short time.

Partnerships Fuel Fintech Innovation

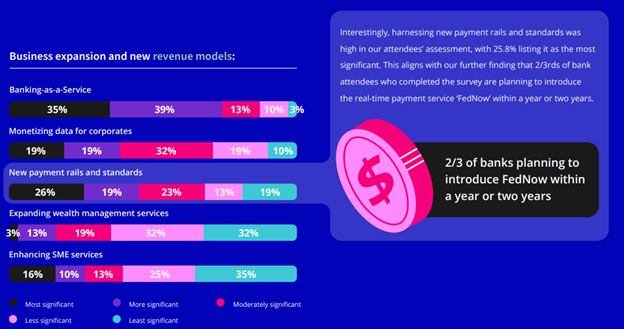

Earlier this year, we examined how partnerships between financial services and technology providers were driving innovation. A recent predictions publication from MoneyLIVE North America 2024 offers fresh data on how these collaborations continue to shape the fintech space. Visual data showing fintech adoption rates or partnership success stories could serve as a powerful tool for illustrating the ongoing impact of these collaborations.

Stablecoin Payments: From Concept to Implementation

In our recent piece on digital money use cases, we explored the emerging role of stablecoins in payment ecosystems. Just a week later, Paxos launched a stablecoin payments platform, enabling instant conversions and faster merchant payouts. Stablecoins have moved from speculative tech to real-world applications, signaling their growing importance in financial transactions. However, regulatory oversight still lags behind, which will be crucial for long-term stability – a point not lost on the U.S. Treasure Department.

Regulatory Frameworks: Stepping Toward Clarity

Previously, we pointed out the challenges posed by the lack of regulatory clarity for digital wallets and stablecoins. Since then, the U.S. Treasury Department has taken a significant step toward establishing a regulatory framework, with Nellie Liang calling for a balanced approach that fosters innovation while addressing risks.

Fintech Trends Shift: Profitability Over Growth

In a recent interview with Emmanuel Daniel, we discussed how fintechs globally are evolving, with a focus on sustainable, profitable models. Just months later, a CB Insights report highlights this exact shift, with fintech companies prioritizing profitability over the rapid growth strategies of past years.

Cloud Computing: The Essential Backbone of Fintech

In our predictions for 2024, we identified cloud computing as an essential driver of future fintech innovations. A recent GonzoBanker report solidifies this view, highlighting how cloud-based data analytics is becoming indispensable for financial institutions. The conversation has shifted from “if” to “when” banks will fully adopt cloud technology to drive more efficient and personalized financial services.

The latest developments in fintech show that the industry is rapidly maturing, with real-world applications, regulatory movements, and technological advancements driving the space forward. As these trends continue to evolve, the fintech landscape is becoming more defined, resilient, and essential to the future of global finance.