FINTECH ARTICLES OF THE WEEK 08/01/17

Global surveys covering second-quarter 2017 FinTech investments are coming in, and the results bode well for the development of the FinTech ecosystem.

“Financial technology startups are on pace to see funding reach a record as insurance, wealth management, lending and blockchain-related companies attract new dollars,” reports Bloomberg. Technology research firm CBInsights, New York, shows in its Q2 2017 Global FinTech report that FinTech firms have raised some $8 billion in the first half of this year in 496 deals globally. (Click the graphic to view the CBInsights report.)

“Global investment in FinTech soars to four-quarter high,” reports KPMG. “Following three relatively lackluster quarters, the global FinTech market rebounded strongly in Q2 2017, with investment more than doubling quarter over quarter to $8.4 billion. . . . After a decline in much of 2016 in terms of volume, investment activity within FinTech overall rose slightly in Q1 2017, only to decline once more by count in Q2 2017, even as overall deal value surged (PDF), thanks in part to one massive buyout in the Americas.”

The United States may be leading the world in deals, but it’s falling behind in payments innovation, according to a FinTech Rising guest post by John Chaplin, Chairman, Global Payments Innovation Jury.

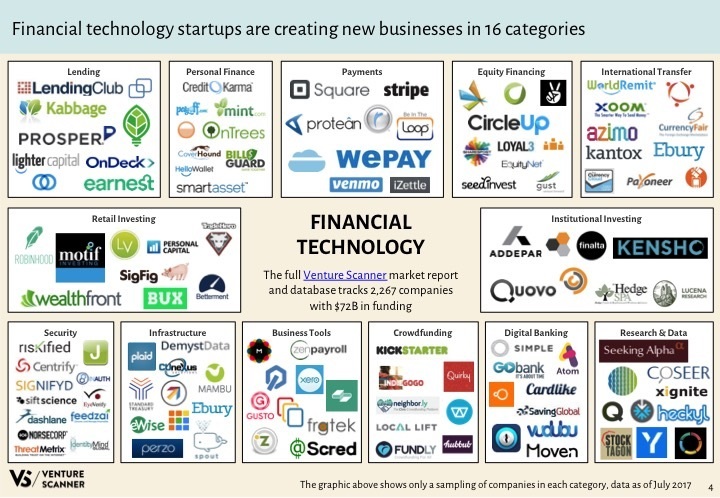

Meanwhile, San Francisco-based VetureScanner puts Q1 and Q2 investments at $11 billion, The research firm provides useful sector distinctions in its funding breakdowns, as shown below. Click on the graphic for the report.

Note that investment estimates from the various firms are not really comparable. Some are venture only while others include private equity, debt, and mergers & acquisition funding as well.

London-based Innovate Finance, using Pitchbook data, is a bit more tempered in its VC investment figures, showing a decrease in global investment in Q1 and Q2 2017 compared to the same period as last year. “H1 2017 saw 787 deals globally, attracting $6.5 billion of VC investment, a 45% decrease year-over-year.”

Most deal activity is centered in the payments sector, “hinting at continued consolidation within that space in particular,” KPMG reports. The insurance sector also is doing well, according to Pitchbook. “Corporate VC arms have been more active in insurance than other industries. One driver of this trend has been recognition of the need for innovation, as well as the fact insurance companies boast large balance sheets, which are already used to make investments to fund claims,” Pitchbook reports, echoing a theme in the other reports that money is flowing from corporate VCs.

Now here’s what that investment money is accomplishing, in the view of London-based FinTech mentor Huy Nguyen Trieu. “The $50 billion of investments in the last few years have laid the foundations – in terms of infrastructure, talents, technology, but more importantly consumer behaviour – of dramatically new business models in finance, which I would summarise with one word: hyperscalability,” he writes in a post. “The IT infrastructure ripple of the last few years has built the foundation for the Fintech tsunami, that will result in the emergence of massive financial groups.”