Smart financial executives are paying close attention to the revolution in financial technologies that is reshaping money and finance worldwide. Innovators and incumbents are moving into the next phase, marked by collaboration where customer needs, expectations, and preferences take precedence over disrupting business models of incumbent financial institutions.

Entrepreneurs are filling gaps in existing services and starting to use new analytical tools to uncover new needs. FinTech Rising 2018 focuses on the changing business context of financial services.

This 100+ page, meticulously researched report gives an overview of the most dynamic changes to financial services in decades. It’s the financial executive’s guide that gives you:

Pragmatic and realistic viewpoints on digital currencies and cryptoassets. Understand how investment professionals are working to integrate this new asset class into mainstream investment strategies and trading approaches.

Insights into the directions financial-services incumbents and financial-technology innovators are charting in U.S. markets. Capitalize on the trends in the principal U.S. FinTech market segments: capital markets, payments, lending, wealth and personal financial management, regulation, banking systems, and marketing & sales.

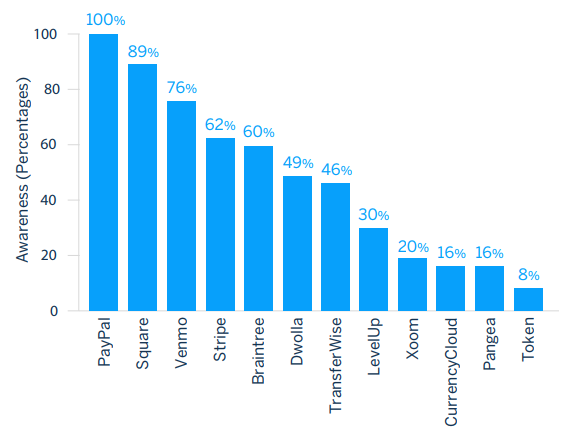

Profiles of the leading firms in each FinTech market segment, including a measure of how aware financial professionals are of the listed innovators. Find opportunities to make your organization more efficient, service customers more effectively, or invest in innovative ideas shaping the future of finance.

FinTech Rising provides overviews of digital transformation in:

- Capital markets and cryptoassets

- Payments

- Lending

- Wealth and personal financial management

- Banking

- FinTech marketing and sales

The report also includes the result of our awareness study for each market segment.

Click here for an Executive Summary and table of contents.

For questions, email service@fintechrising.co.