Already fulfilling the basic financing needs of small businesses, alternative lenders may help fill the gap in getting Payroll Protection Plan (PPP) money to small businesses. Since the program opened and ran out of money, nonbank lenders got approval to provide PPP loans. I had emails in my inbox from Ondeck (I’m a customer), Square Capital, and PayPal.

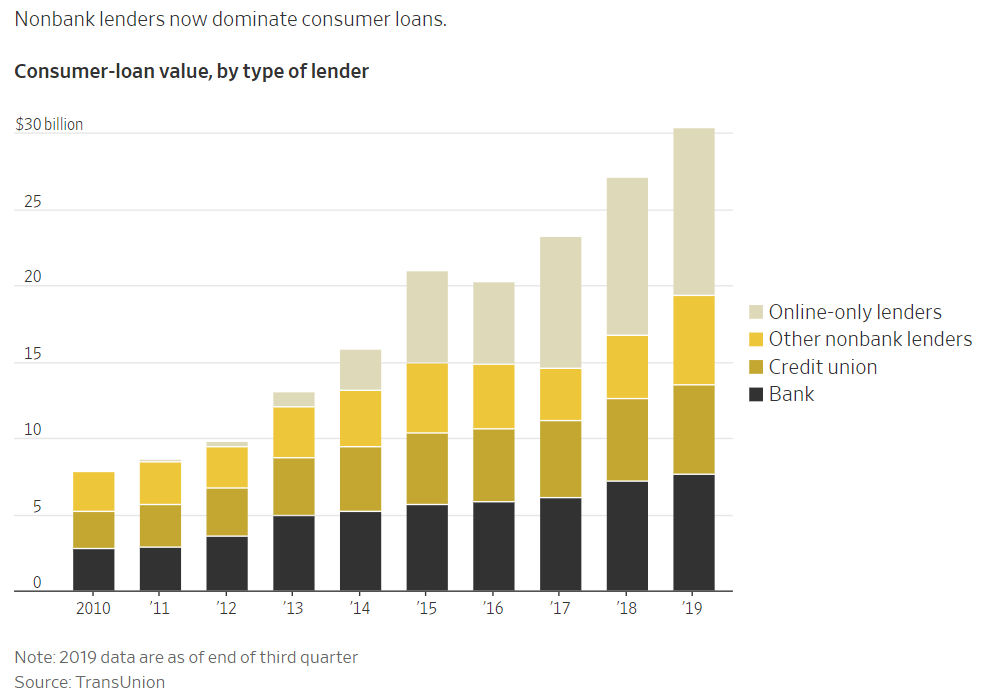

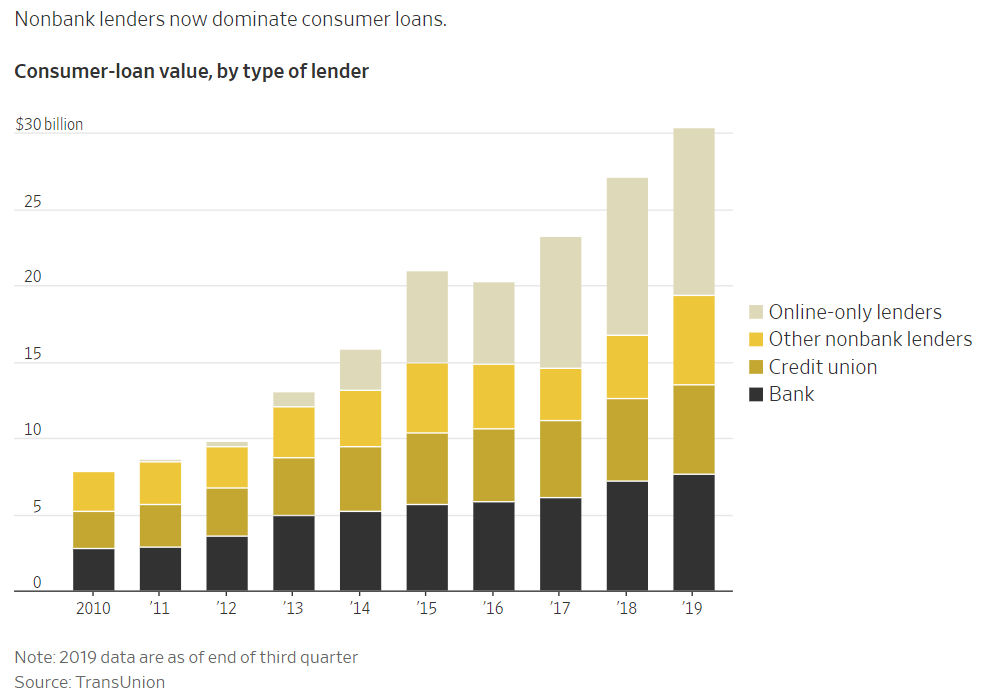

This indicates an ongoing shift toward alternative lenders. The April 24, 2020, issue of The Wall Street Journal displays a telling chart in the article, “Banks Make Weak Fed Partner.” The chart documents the rise in online, alternative lending and shows that “nonbank lenders dominate consumer loans.”

The same trends, though likely they won’t lead to dominance, are taking place in SMB lending, as evidenced by this quote from a Business Insider report on Alternative Lending: “According to a survey from the Federal Reserve Bank of Richmond, in 2016 only 58% of loan requests from small businesses were approved by incumbent banks, compared to 71% approved by alt lenders that same year.”

OnDeck, a US-based startup that offers small business loans in this space, shows there are pitfalls and need for caution in this approach as well, though, following a $59 million net loss for the first quarter of 2020. The alt lender, which makes loan eligibility determinations via algorithm, had already been struggling against competitors in the niche, but the coronavirus has sharply worsened its losses. They’re now reportedly up for sale, per Crowdfund Insider.

For careful lenders, however, potential in the space remains strong, as the arguments for alt lending remain strong. Easy, efficient loans have strong upsides for businesses – particularly when dealing with the challenges of a program like PPP, which asked for very rapid deployment of something approaching a 10 time increase in what is traditionally a $30 billion a year market.

“Wells Fargo responded terribly to PPP, but Lendio knocked it out of the park,” said Matthew May, Founder of Acuity Financial Experts, in a recent Tech In Motion webinar, referring to the largest of the small business loan platforms. “You have to take stock, though; how does Lendio maximize that opportunity? People are saying they want to move all their business away from legacy institutions like Wells, but how do they capitalize on that?”

That crucial follow-up could prove tricky for alt lenders, even in the context of PPP itself. It’s true that new applications for the loan program have slowed to a trickle in the face of unclear guidelines and public backlash against some applicants. However, many lenders are still bracing for a flood of applications for existing applicants to take advantage of the loan-forgiveness part of the program. Every recipient of a PPP loan is eligible to apply for forgiveness, and the paperwork involved is significantly more complex than the loan requests themselves.