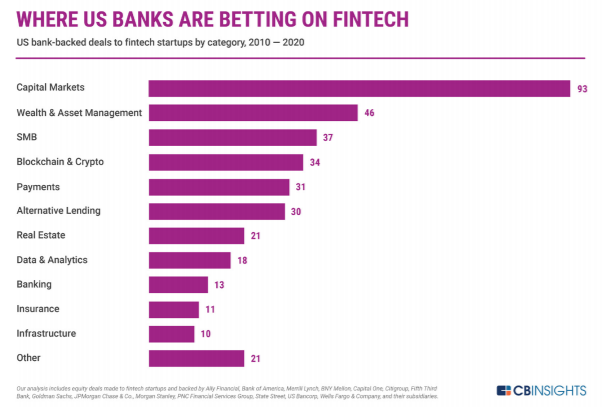

U.S. banks made more than 65 strategic bets in FinTech in 2020. Capital markets investments led the way. “Despite the economic uncertainty surrounding the Covid-19 pandemic, U.S. banks are future-proofing by actively investing in FinTech,” research firm CBInsights concludes in a report released last week.

Deals in the capital markets category more than doubled those in the next category, wealth and asset management. Blockchain and crypto finance investments by banks cooled in 2020.

Venture capital firms picked up the slack in crypto and blockchain investments in the first quarter of 2021, according to another CB Insights study covered by Bloomberg. “In the first quarter, 129 startups focusing on the digital technology known as blockchain raised about $2.6 billion, according to CB Insights. That’s more than in all of 2020, when they attracted $2.3 billion in 341 deals, according to the data analysis company.”

Banks in Illinois are taking cues from the VCs as they seek to become more friendly toward cryptofinance. A bill passed by the Illinois House that would allow special-purpose trust companies to hold cryptocurrencies in custody counts the Illinois banking industry’s associations among its supporters. (The publisher of FinTech Rising is also a supporter.)

At the same time, banks are increasingly under pressure in their traditional payments and money management businesses as consumers turned to apps provided by FinTechs like Square and PayPal, Bloomberg reports. As crypto remakes the financial system, the Illinois banking industry is looking in the right direction.