The FinTech revolution has transitioned to a product-development revolution for traditional financial institutions. What I heard at the MoneyLive North America conference, held September 16-17 in Chicago, sounded more like product- and software-development, not FinTech disruption.

Conference speakers and presentations that covered both the business and technology sides of financial application engineering in three themes:

- Customer experience

- Infrastructure renovation

- Technical partnerships

Customer Experience (CX/UI)

The “customer experience” (CX) theme emphasized creating products customers will love and use because they solve their financial problems and help them reach their goals. A customer-focused approach supported by contemporary software development tools is difficult for financial institutions, even with external partners providing the technology lift.

Whatever legacy technology and regulatory hurdles financial institutions face cannot interfere with how well a product works for customers. In product technology terms—because this was a business and technology conference—that requires an intuitive user interface (UI) on products.

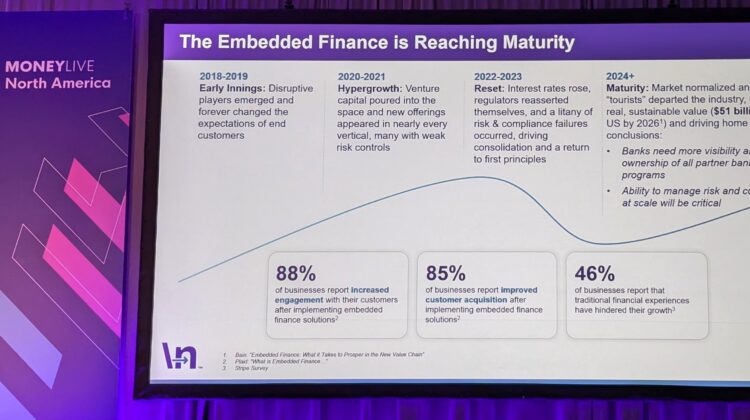

Business-focused concepts here include “embedded finance” delivered by means of “banking-as-a-service.” BaaS combines financial product expertise with modern technology prowess. With that combination, BaaS-oriented firms can help nonfinancial businesses deliver financial products, including payments, investments, and insurance. Customers can click to buy insurance when they make a deposit or pay when they get an invoice.

Infrastructure Renovation

The “infrastructure renovation” theme was composed of examples that started with the utility of data. In 2017, The Economist noted that “data are to this century what oil was to the last one: a driver of growth and change.”

Products that make that change real are still being designed and developed, especially in financial services. For most financial organizations, this is a process of renovation, not transformation. The technologies used are not new, like cryptocurrencies, but next generation, like realtime payments.

Data-based products are delivered through current application programming interface (API) systems and powered by cloud computing services. These are still new technologies in the context of the legacy data and hardware systems that make up many banking technology stacks, but the overhaul and rebuild required to put them in place can result in more practical and perhaps profitable financial products. They provide data to a UI that could, in one example I heard, show where a payment is in the process from initiation to receipt and reconciliation, just as shippers do with packages.

Technical Partnerships

The “technical partnerships” theme initially sounded like partnerships between banks and financial technology firms. Throughout the conference, the theme developed to include the partnerships between a financial institution’s business, product, and technology departments.

Those partnerships are most critical to developing products, whether they are done in partnership with FinTechs, technology vendors, or in-house developers. MoneyLive speakers provided excellent examples of each. In all of them, the central theme was collaboration, a give-and-take between the business and product concerns and the technical architecture and tools.

Lay out the business, customer, and data needs, then work out the technologies to make them sing, to paraphrase several speakers. The elements of technology infrastructure are not ends in themselves but enable products to provide greater value to customers with less friction and higher speed.

Realtime payments, cloud computing, and the technologies that enable connected finance can be difficult and expensive to incorporate in the technology stacks at many banks. They may or may not be less expensive, depending on the legacy systems they replace or interact with. But they are critical to the ongoing renovation of U.S. financial products.

Slide Credit: Fifth Third Bank in a presentation by Dan Dall’Asta on Banking as a Service.