David Carman and George Vukotich, co-founders of the FinTank incubator, are pursuing a vision of Chicago as a center of cryptoasset trading.

More than 120 other FinTech professionals share that vision enough to have spent a couple of hours on Monday, Mar. 18 in the Loop discussing how to make the vision a reality. It was a positive atmosphere, and I’m glad I was there.

“Chicago is a trading town,” observed Carman, a long-time trader. The exchanges and traders are already here and working with cryptoassets.

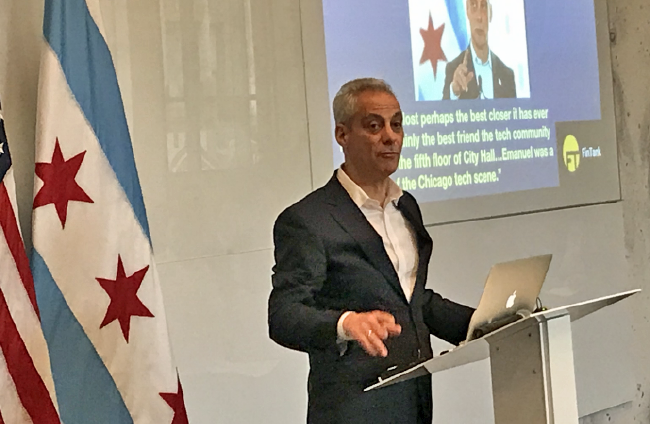

It’s also a hub of higher education, as Chicago Mayor Rahm Emanuel pointed out in a talk that started with the usual rundown of Chicago’s economic and education benefits. The top initiative he sees for the future of Chicago is the building of the University of Illinois’s Discover Partners Institute, a research hub proposed for the city, he said. “Brainpower is everything.”

Strong education makes strong cities, and strong cities are the future. “Nation states are falling apart,” Mayor Emanuel said. “City states are emerging.”

It’s an important observation in part because it speaks to the frustration many feel over a national government that barely works. City and state governments have picked up the slack.

Emanuel went on to say that he believed it would be a country with a broken economy, in which a national currency collapses, that finds cryptoassets as a way to reestablish a viable means of exchanging economic value. In other words, that widespread adoption of cryptocurrencies and cryptoassets would result from financial crisis.

(I have, by the way, thought that a state or city in poor financial condition, like Illinois or Chicago, would be in a position to experiment with cryptoassets as solutions to real problems, like payments in the burgeoning cannabis industry.)

Mayor Emanuel’s key insight is that Chicago will not become a cryptoasset or FinTech capital based on trading alone. Until cryptoassets gain the traction of usage by a critical mass of the population or become the solution to widespread business problems, the title of crypto capital will not hold all that much weight.

Markets and means of exchange must make sense to more people than the financially and technologically savvy. That’s a good starting point.

The broader challenge lies in cooperation and coordination among the city’s financial and technology organizations, something that Chicago is not exactly known for, and broadly based education of government officials, politicians, and the general public.

“You have to engage legislators locally,” Mayor Emanuel said, “and explain why it’s important, how it will propel the state and bring in jobs.”

For detailed coverage of the meeting, see Benjamin Pirus’s article in Forbes.