Richie Serna, CEO of Finix Payments, has had a front-seat view of the rise of FinTech payments. In a conversation with Collin Canright, Richie talked about

- His on-the-job education in payments integration.

- The influence of his immigrant parents and how Finix got its name.

- Competition with FinTech payments leader Stripe.

- The history of payments distribution.

- The future of realtime payments and SaaS platforms.

Collin: How did you get into payments?

Richie: One of my close friends and mentors was the cofounder of Balance (which provides B2B payments services). He loves to say that it’s always happy accidents. I had worked in management consulting for years, and I was breaking into the startup world looking for my first engineering job. I had no interest in payments. It’s so ubiquitous that you take it for granted. The engineers I met at Balance were some of the best engineers in Silicon Valley. They were contributing to Python, to Ruby. They were some of the top posters on Hacker News. They were writing books on great API designs.

That would be my first engineering job. And they threw me in the deep end. My first day on the job, it was doing developer integrations. They’re just helping people integrate into our payment APIs (in programming languages) Python, Ruby, Java, PHP, C. It was probably one of the best educations in payments of all time.

Balance was one of the early payment facilitators. We had integrated the main processors here in the U.S. and got to understand what it really meant. Our sort of claim to fame was that we were the first payments API designed specifically for marketplaces for SaaS platforms and P2P networks. When you get in on that ground floor you get to see how the sausage is made and really understand the deep intricacies, complexities, the esoteric nature of payments technology. That just really hooked me in.

So I’ve now been in payments for 11 years and still, you know, going deeper and deeper into the rabbit hole of payments. Last year, we became a full stack acquired processor. So we now have direct connections to Visa, MasterCard, Amex, and Discover. It’s still super fun. It definitely sounds super geeky.

It’s a geeky business, there’s just no other way about it. Almost everybody I know seriously in the business will refer to themselves as a payment geek.

Yeah, exactly. I remember when I first told my mom that I was in payments. She’s like, so you work at Visa. And I said, we all kind of work for Visa.

So about the company name, Finix. How did you come up with the name? What does it mean?

We sold Balance to Stripe back in 2015, and then shortly after that, I started with Finix. But we hadn’t incorporated the business and didn’t have a name. It wasn’t a priority for us. And so when we closed our first customer at the beginning of 2016, we had basically less than 24 hours to pick a name. My parents are Mexican immigrants. They came here undocumented back in the 60s; that’s definitely a big part of my identity, so I thought of naming the company something in Spanish. I texted my mom that day. I thought about names for money or money movement or payments in Spanish and didn’t necessarily fall in love with any of them.

But one of my friends suggested Phoenix Payments, and I did not like that at all. And then I was like, wait, but what about “Phoenix” in Spanish? “Phoenix” in Spanish is “Fénix,” and then I thought, oh if you switched the é with an I, it’s a made-up word, and it’s available. One of the things I’ve always admired about some of the most memorable payment companies out there is they don’t focus the name on “payments.” So they stand out.

I do want to ask you about Stripe because of the TechCrunch headlines on Finix competing with Stripe. There’s quite a difference in the size of the companies, as you mentioned. Tell me more about your competitive advantage over Stripe.

When it comes to differentiation, it’s typically these smaller decisions that end up compounding over time to build a differentiated product. Amazon will tell you that they don’t have one single bullet feature that really differentiates Amazon. It’s their investment in their logistics, their marketplace, their infrastructure, their distribution model. All of those things combined are really what formed the strength of Amazon.

We think about that in the same way when it comes to payments. We think about the differences between Stripe and Finix, with them like iOS and ourselves like Android. You see it in terms of their business practices where they’re really trying to lock you into their ecosystem. Our is offering configurability and choice and optionality. A specific example comes down to the various device strategies. Stripe bought a hardware company called BBPOS, and they force everybody to use that hardware. We don’t believe that only one device is going to work for everybody.

So that’s where you get to Apple to Android comparison.

Yeah, exactly. It’s a very different world when it comes to our customers. They care about form factors. They care about price points. They care about the devices that they’ve had out in the market for years, right? The device that works for the restaurant is not the device that’s going to work for the field services worker who has to have mobile capabilities.

The second distinction that we really think about: the persona that we’re building for. Stripe’s historic focus has always been on the developer—the developer at the expense of the non-technical user. We believe that having great APIs is absolutely core to what we do. But our goal is really to be the low-code, no-code leader in the market, really empowering the non-technical users. But the power user of payment products is not the developer. The power user is the back-office team accounting. It’s the head of payment operations.

And the third part is our support. We’re not just going to throw, you know, documentation at our customers and say, hey, read these thousands of pages and teach yourself payments. We hand-hold our customers with a white-glove experience. And our Net Promoter Scores (NPS) over the last year and a half have been in the high 70s, which for any type of B2B product is absolutely out of the norm when it comes to payments.

I think it’s refreshing that you have real support people because that’s not what I consider the Silicon Valley norm.

It’s quite fascinating. I think there’s two things that have happened in Silicon Valley that have sort of permeated the culture and forced people to think in that way. One is this idea that everything should be product-led growth. Everything should basically sell itself. It should be a completely self-service experience. But nothing is really completely self-service. A real person is a huge differentiator. Having great developer docs is absolutely critical and important. That’s a necessary but not sufficient part of a great product and customer experience.

Finix is widely known as “embedded payments,” a term I don’t especially like. It’s a bit vague. What does embedded payments mean to you and Finix’s strategy?

It’s funny because there’s been a whole conversation about the difference between embedded and integrated payments. And if you look in the dictionary, they are synonyms, right? There’s not really a lot of distinction that comes from those words.

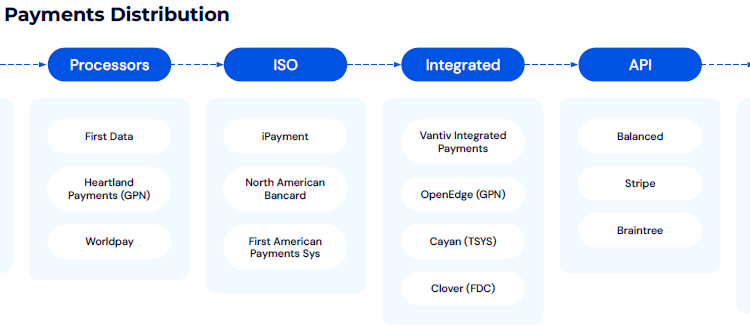

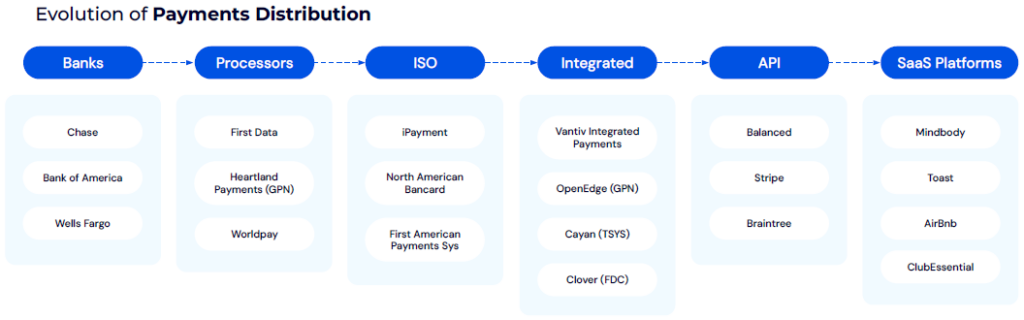

One of the critical themes that has been core to Finix and to our experience in payments as a whole is the distribution model of payments. When I say the distribution model of payments, I mean who are merchants going to when they’re signing up for their payments experience?

Source: Finix Payments

Source: Finix Payments

Back in the 60s, when Visa was first rolled out, you had to go directly to one of your banks, and they would underwrite you for a merchant account. Then you had the processors who built the technology for the banks, who said, hey, if we’re building this tech, we might as well go to market and start selling it directly to merchants and capture a chunk of that acquiring economics.

Then in the 80s you had the ISO model. So basically, the banks and the processors said, We don’t have enough boots on the ground to be able to sell it to every single mom-and-pop shop, every single restaurant around the country. Let’s have this massive sales force that we can now create. That really resulted in a referral model, and the first intersection of payments and software came about with this integrated payment model.

Mercury is probably one of the earliest players in that space. They basically said, you have the point of sale at restaurants and retailers that’s completely decoupled from the payments experience. You can go into a small liquor store, and they’ll do the tally of the inventory in the point of sale, and then they’ll manually key in the data into the actual payments hardware itself, and then you swipe your card. It’s very similar to the experience of PayPal and eBay back in the day where you would list your products on eBay, but then you go PayPal to get signed up for payments.

In 2010-12 you had companies like Balance, where I worked. Stripe and Braintree were really the first ones to push more to that developer-centric approach, which became a new wave that people talked about—embedded payments, embedded FinTech. It’s one further step in that model where you see SaaS platforms in specific verticals that completely embed payments as a part of their product experience and as a part of their revenue stream. The platforms will go after a specific market segment and build all the workflow tools and business operations solutions necessary to manage the day-to-day operations of that business. Then they layer in payments as a core part of their payment strategy.

That’s really interesting. How does that influence your business now?

Oftentimes, those merchants have no idea that a company like Finix is the one that’s providing that payment infrastructure. Now, these SaaS platforms have effectively become the Square of their industry: the Square for gyms, the Square for restaurants. We’ve seen firms in every single vertical taking this approach where they’ll go and corner this more niche market and increase their total addressable market by layering in payments.

I think one of the things that we see here at Finix is a world where these vertical SaaS companies become the banks of the future. They not only offer the software to manage the business, they manage operations and then they layer payments, they layer in lending, treasury, payroll, and all of the products and suite of solutions that you typically see on a commercial bank’s website. They’re now starting to unbundle all those products and rebundled them within the SaaS platform.

That leads to my last topic, the one that initially caught my eye. You’re using Visa Direct and Mastercard Send for your Finix Payouts product, and I wonder how you are seeing the adoption of faster and realtime payments.

It’s 2024, and even today, payouts to customers still remain a tremendous friction point. So our goal with payouts is to enable businesses of all sizes to send funds directly to a card or to a bank account via a single API or using a suite of no-code and low-code solutions. The part that’s exciting about push-to-card is that you can take an existing debit card or credit card and send funds to it in real time, 24/7 365 days a year.

Historically, it’s taken months of development work and months to get approved by a bank for this. Now you can set it up through Finix in a day and start moving money in real time. It’s super exciting for our customers. We’re seeing payouts use cases like insurance claims, loan disbursements, and lost baggage fees for airlines. We’ve seen basically every use case for accounts payable. So we can now help our customers bring faster payments to their customers without having to build their own connections to banks or to Visa Direct or Mastercard Send directly.

Well, I think that’s a good place to end. It’s been a pleasure. . .