Private and public investments in FinTech firms surged in the first quarter of 2021. Research firms are predicting that 2021 will set a record for FinTech funding.

Understanding what sectors and regions receive venture funding provides perspective to traditional financial institutions, notes The Financial Brand in its coverage. “Seeing where venture capital money is flowing. . . can assist in prioritizing strategies.”

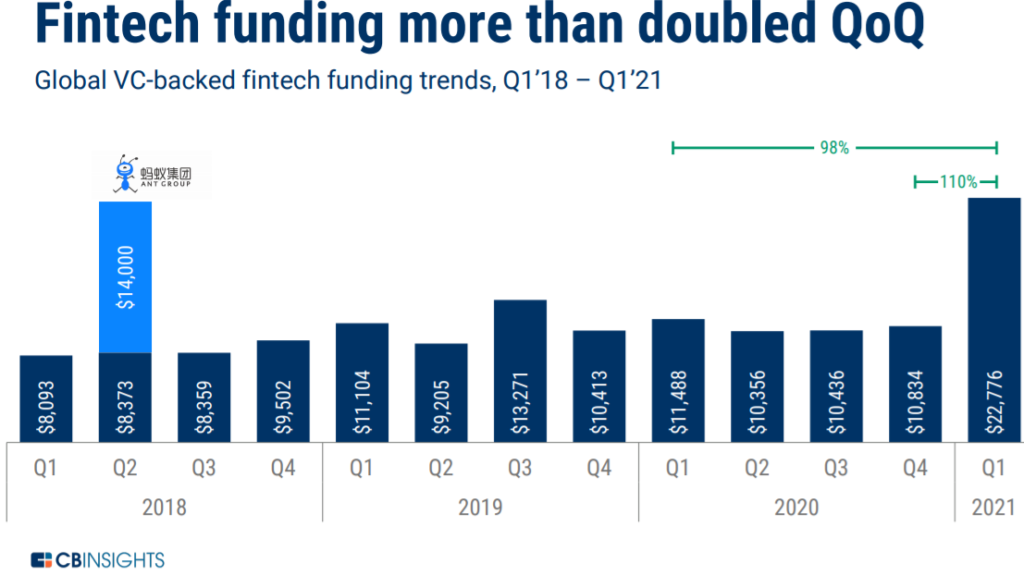

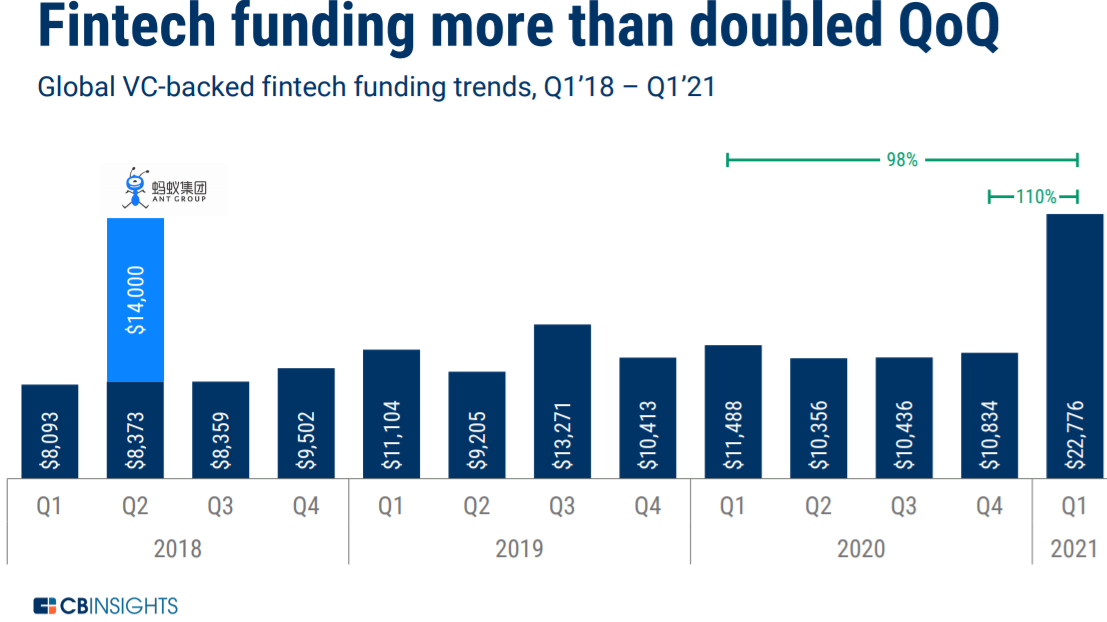

Global investment in FinTech companies more than doubled in the first quarter of 2021 over Q4 2020, reaching $22.8 billion in 614 deals, reported research firm CB Insights.

FinTech investment bank FT Partners called Q1 2021 “the largest and most active quarter ever for FinTech financing activity,” putting the total raised at $29 billion in more than 750 transactions. Lending, Payments, and Financial Management sectors led investment activity in North America.

Venture capital investment in cryptocurrency and blockchain startups hit a record on the back of increases in bitcoin prices. Pitchbook, which tracks private investments, put total investment at $3 billion across 239 deals.

CB Insights underscored the point with a headline, “Digital asset custody and investment hit the mainstream.” Three crypto-focused FinTechs received sizable investments and launched new crypto investment products.

Meanwhile, cryptocurrency prices continued their wild ride. Bitcoin and other cryptocurrencies took a beating Friday after further announcements from Chinese financial regulators.

China’s Vice Premier Liu He reiterated the China State Council’s Financial Stability Committee’s intention to limit cryptocurrency use. The country’s highest-level financial market regulator made similar pronouncements in 2017 and 2013.

Friday’s statement seems to go further. “When they vowed to “crackdown on bitcoin mining and trading activities,” that most likely means that there will be new regulations – and more serious enforcement of existing regulations,” says Winston Ma, CFA, Esq. and adjunct professor at NYU School of Law.

All in all, the events of the week show that the emerging decentralized finance market is working.

- Elon Musk won’t hold sway over crypto price swings forever, says Ethereum founder Vitalik Buterin.

- A link to a 2017 SEC warning not to trust celebrity investment endorsements resurfaced.

- The bitcoin crash was a big win for cryptocurrencies, writes market analyst Jim Bianco.

“The decentralized protocols, which many claim are the future of finance, worked as designed and never went down. While customers grumbled about market losses, they were not complaining that these systems failed them at a critical time.”