Cryptofinance is relevant again. The launch of bitcoin exchange-traded funds early in the year helped bring bitcoin returns up about 45% year to date. This week’s annual Bitcoin conference put the crypto asset originally designed as a means of payment at the front lines of U.S. politics with a speech by Donald Trump. “Trump makes promises without saying much,” Blockworks reported. These recent reports provide details that the candidate did not:

Stablecoins. Moody’s Corp., the rating service, published a stablecoin market overview on stablecoins, “Growing popularity of stablecoins exposes investors to multiple risks.” Stablecoins are designed to remove price volatility from cryptoassets and serve as a means of transferring value from one cryptocurrency to another. Their use is increasing, the report shows. “However, because they are not always as stable as their name suggests, they require proper safeguards to ensure they do not introduce hidden vulnerabilities into the financial system.” Risks include the quality of the assets used to back them, the governance of token issuers, and the robustness of their underlying technology. Traditional financial practices, such as the segregation of assets and the quality of custodians, also count. Although the report does not point to major incidents, it does point out a lower level of transparency in the disclosures of some issuers.

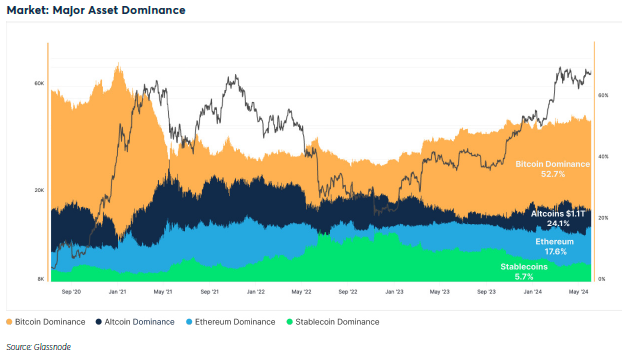

Institutional Adoption. How much risk any cryptoasset poses to the financial system, however, depends on the overall adoption of the asset class and its relationship to the financial system as a whole. The total market value of cryptoassets is in the neighborhood of $2.5 trillion, a rounding error in terms of the U.S. economy. Even so, “the digital asset space has grown significantly over recent years and experienced an expansion in institutional interest, especially as a macro asset class,” reports CME Group and Glassnode in their highly detailed “Digital Assets: Market Trends and Analysis H1 2024.” Coinbase proposes a new method of measuring adoption to better gauge total adoption, including nonfinancial use of cryptoassets in its July 24 market adoption report. “As onchain applications expand, creating appropriate new metrics to track activity growth and network “health” becomes increasingly important,” the report states. I make no pretense that I understand the report, but like the CME-Glassnode report, it’s clearly real research, and that counts for a lot.

ETH ETF. Over the last few years, the U.S. Securities and Exchange Commission has done its best to keep adoption in the U.S. at a minimum, unless it is through established financial institutions. In that regard, Blackstone has been a clear beneficiary, a position it can claim with last week’s approval of an Ethereum ETF. Bloomberg reports that more than $1 billion worth of shares traded across nine new ETFs. Crypto lending is also back in vogue, reports the Financial Times.

Advisor Interest. As cryptoasset prices increase, so does the interest of investors, an estimated 40 million of them. That makes cryptoassets important to financial advisors regardless of their opinion of cryptoasset investments, just as the opinions of these investors should be more important to U.S. political candidates, regardless of party affiliations. Earlier in the year, my firm worked with Morningstar to help write a white paper that provides insights into the importance of cryptoasset visibility for financial advisors. This includes the considerations advisors should discuss with clients regarding the implications of their cryptoasset investments and the tools that firms can offer their advisors to gain visibility into the generally hidden direct investments clients make in cryptoassets. “We’re at the point of reaching mass acceptance before mass adoption when it comes to cryptoasset investing,” said Tyrone V. Ross Jr., CEO Turnqey Labs, “which basically means that we know that cryptoassets are not going away.”