Are you keeping up with the rapid advancements in cross-border payments? From significant speed improvements to the integration of cutting-edge technologies like Distributed Ledger Technology (DLT), the landscape is evolving quickly. How are these changes impacting global finance, and what can we expect for the future of financial transactions?

This week we look at a series of insightful reports that explore these questions in detail, including the PitchBook Analyst Note and McKinsey’s discussion on the industry’s shift towards simpler interfaces amid increasing operational complexity. Whether you’re a financial professional or just interested in the financial sector, these reports provide a comprehensive overview of where cross-border payments are heading.

Currency Crossroads: A Cross-Border Payments Deep Dive

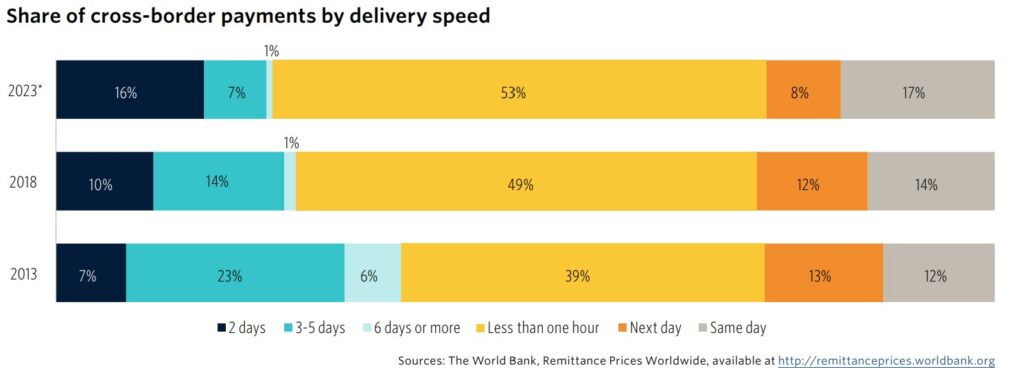

The Q3 2024 PitchBook Analyst Note titled “Currency Crossroads: A Cross-Border Payments Deep Dive” offers an in-depth analysis of the current trends and state of cross-border payments, serving as both a market introduction and a trends report. It highlights significant improvements in payment speeds over the past decade. A chart on page 31 illustrates these changes, showing an increase in payments reaching recipients within one hour from 38.7% in 2013 to 52.7% in 2023. The same period saw same-day transfers rise and three-to-five-day transfers significantly decrease. This comprehensive report underscores the evolving efficiency of global financial transactions. You can check out the full report here.

Global Payments in 2024: Simpler Interfaces, Complex Reality

The McKinsey article on global payments in 2024 discusses the evolving landscape of the payment industry, emphasizing simpler user interfaces against a backdrop of increasing complexity in operations. A particularly interesting part of the discussion is illustrated in Figure 3, which provides a clear visual of the projected growth in different payment methods. This chart is key for understanding which technologies are gaining traction and how they’re expected to shape the future of transactions. The overall article underscores the need for companies to adapt to these changes to stay competitive. For a deeper dive, you can read the full article here.

Annual Progress Report on Meeting the Targets for Cross-Border Payments: 2024 Report on Key Performance Indicators

The Financial Stability Board’s 2024 report on cross-border payments reveals modest global progress toward meeting the G20 targets set for the cost, speed, and transparency of these transactions. The report underscores persistent regional disparities and emphasizes the ongoing challenges in achieving tangible improvements. It calls for strengthened efforts and collaboration across the public and private sectors to better meet these objectives. The implications for the future suggest a continued push to enhance the efficiency and inclusivity of global payment systems. For more details, check out the full report here.

The Evolution of Cross-Border Payments: From SWIFT to DLT

The evolution of cross-border payments marks a significant moment in global finance, tracing from ancient bills of exchange to today’s advanced technologies. This progress is addressing issues like high costs and slow processing by integrating technologies such as Distributed Ledger Technology (DLT). DLT promises near real-time settlements, enhanced security, and compliance, aligning with G20’s goals to improve global financial transactions. Innovations like Blade Labs’ Digital Asset Platform are pivotal, offering modular, secure solutions that could reshape international finance. Yet, challenges in regulation and adoption remain as we push towards a more interconnected and inclusive financial system. Read more about this transformation here.

Modernizing Cross-Border Payments

Around the globe, financial systems are adopting ISO 20022, a standard aimed at unifying financial messaging formats. This standard enhances the capabilities of financial messages to include structured remittance information, improving reconciliation, traceability, and transparency in cross-border payments. It also supports AML automation and KYC activities. SWIFT is spearheading the adoption, with significant migration expected by 2025, predicting 90% of cross-border payments will be compliant. This standard is also being integrated into major domestic real-time payment systems, enhancing the connectivity and efficiency of global financial transactions. For a deeper look, check out this whitepaper here.

Additional Reading…

Real-Time Cross-Border Payments Fintech Nium Partners with Bank Rakyat Indonesia to Enable Money Transfers

Fintech company Nium has partnered with Bank Rakyat Indonesia to enable real-time cross-border payments. This collaboration aims to improve the speed and accessibility of international money transfers. For more information, you can read the full story here.

Temenos Launches SaaS Solution for Cross-Border Payments

Temenos has launched a new SaaS solution aimed at simplifying cross-border payments for financial institutions. This platform uses advanced technology to improve the speed and accuracy of payment processing. For more information, you can read the full article here.

Mastercard Transforms Cross-Border Payments for Banks with Industry-First Innovation

Mastercard has introduced a new innovation that simplifies the process of handling cross-border payments for banks. This first-of-its-kind advancement aims to improve the speed, transparency, and efficiency of international transactions for financial institutions. For additional information, you can read the full announcement here.

As we wrap up our exploration of the latest advancements in cross-border payments, it’s clear that the journey from ancient trade practices to today’s digital innovations is as thrilling as it is impactful. With each report and development—from PitchBook’s deep dive into improved payment speeds to Mastercard’s pioneering solutions—it’s evident that the future of global finance is bright and bustling with potential.

As we continue to witness these transformations, staying informed and adaptable will be key to navigating this dynamic landscape. Ready to see what’s next? Keep an eye on these evolving trends and join us as we move towards a more connected and efficient global economy.