The surge in financial technology, encompassing every sector of financial services, shows no signs of stopping, despite some highly publicized problems. A recent Accenture survey, for instance, puts global investment growth at $5.3 billion, a 67% increase over last year, with total investment at just over $22 billion.

FinTech is a shorthand for technologies, ranging from mobile banking to digital securities clearing, that are bringing about the digital transformation of banking and finance. As financial services and banking converge with internetworked, mobile, and massively databased systems, FinTech has become wildly explosive in financial services.

The tools developed by innovative FinTech firms are empowering individuals to gain greater control over their financial destinies and enabling smaller, incumbent financial institutions to compete with large global institutions and technology firms.

Payments and lending startups lead in both funding and consumer acceptance. Proof-of-concepts for cryptofinance projects are receiving attention from global financial institutions and attention from financial media. They are also receiving the highest levels of venture funding.

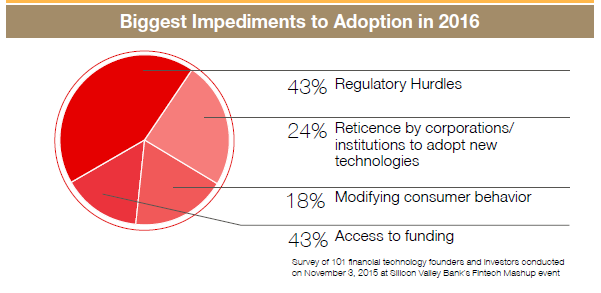

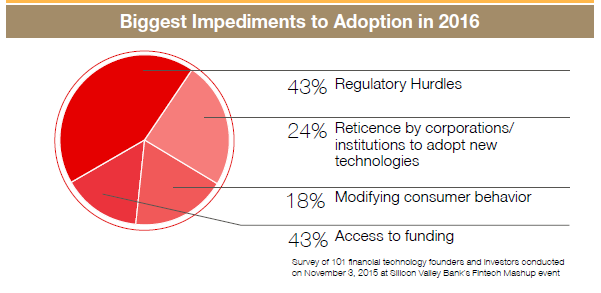

As money continues to move into FinTech startups from venture firms and newly formed innovation organizations at established financial institutions, regulators are starting to take notice, a trend sure to accelerate. Also look for increased partnership and cooperation between FinTech startups and incumbent financial institutions throughout the rest of the year.

Download and read the complete report.

As for this week’s links:

What is a bank?

Banks are going through an existential crisis, and the Wall Street Journal spent the week telling us how, why, and where the industry may go. It’s a series of must-read articles. As for FinTech, the Journal gives a bit more dire take on the trend toward partnership between banks and FinTechs: “It’s most likely that the small fintech companies will be subsumed into the bigger maw, but one can’t underestimate the long-term impact of their ideas.”

FinTech property rights and banks

The financial services industry spends millions of dollars on title searches and insurance annually, but who owns the intellectual property behind the technology? In the past, financial institutions knew that those who manufactured it were the owners, but today ownership isn’t so clear cut, BAI Banking Strategies reported.

Chip and signature credit cards are not the answer, but are these payment innovations any better?

There are more payments options available to people now, but none of them is flawless. EMV cards, interactive cards, tap-n-go, and handless payment methods are all pushing payments into the future, but they have a long way to go in combating fraud, simplifying authorization and improving conveniences, according to Nikki Baird for Forbes.

Millennials say Venmo turns them into stingy jerks

Are payments apps making young users stingy? Yes, services like Venmo and PayPal are making it easier for users to split costs, but in an article for Inc. Magazine, some users say the app opens them up to unprecedented “stingy” behavior.

Sydney aims to be more like Silicon Valley, can FinTech do the trick?

Sydney, Australia is trying to become the new tech city, and its efforts are focused on drawing in FinTech companies. Though Australia has the universities, engineers, accelerators, and incubators to nurture tech growth, the culture remains quite slow and bureaucratic, writes Rebecca Fannin in a post for Forbes.