During a week that featured a dramatic battle over crypto taxation in the U.S. Senate, a major recovery in the price of bitcoin and ether, and the most bizarre crypto hack and recovery ever, the steady interest in decentralized finance by institutional investors continued.

The evidence: a steady stream of comprehensive DeFi research for institutional investors. The motivation: yield.

You can read how the cryptocurrency community came together during the week to fight – and ultimately lose – a battle in the Senate. Yet it was a turning point and moral win for the industry, Michael J. Casey, CoinDesk’s chief content officer, points out in an editorial. (He also notes that this turning point comes 50 years after President Richard Nixon removed USD’s peg to gold.)

The crypto taxation provisions are widely viewed as flawed, and the U.S. Treasury set about by week’s end to quell fears that the crypto tax rules are overly broad, as Bloomberg reports.

All I can say about this $600 million DeFi theft, which the hackers returned, is you can’t make stuff like this up.

As the profile of crypto raises, however, organizations that provide the technical, investment, and regulatory underpinnings of decentralized finance have been cranking out the research. This set, most accessed through the TabbForum, provides a good introduction and how-to guide to the present state of institutional investment in decentralized financial products.

DeFi for Institutions. ConsenSys, a blockchain technology company that focuses on Ethereum development, covers the basics of trading on decentralized exchanges, using lending protocols, and farming for yield. Given the publisher’s background, this report provides the best introduction to Ethereum-based systems.

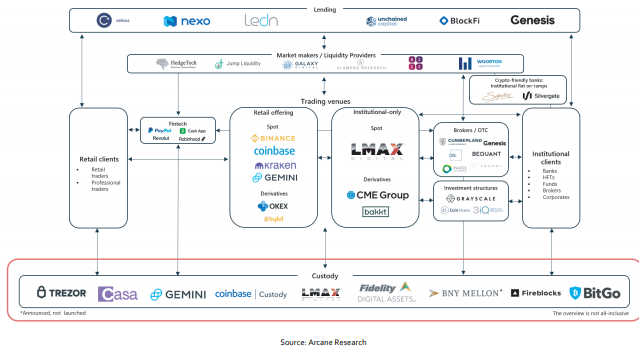

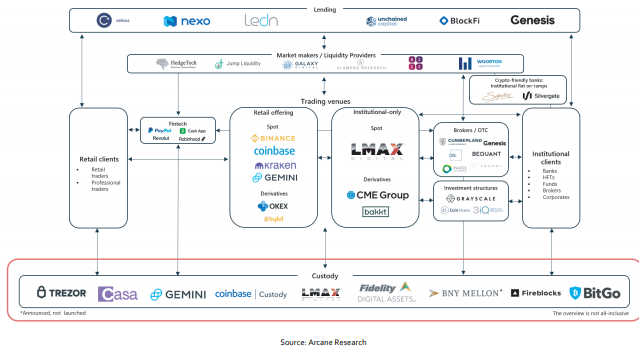

The Bitcoin Trading Ecosystem and the Emerging Institutional Infrastructure. Arcane Research, which specialized in crypto analysis, produced this guide for LMAX Digital, a crypto exchange designed for institutional spot trading. This report covers the exchanges, traders, banks, and asset servicers that help institutional trade bitcoin. The charts that diagram the relationships between the ecosystem players, all designated by logo and function, are especially useful. The bitcoin custody view is shown below.

Diving into DeFi. Fundamentals from the Financial Frontier. Merkle Science, which provides transaction monitoring and criminal detection technology, provides the most comprehensive introduction to DeFi terms, protocols, and platforms. If you want to know the difference between, say, SushiSwap and Uniswap, it’s explained in this report. So are the methods, mechanisms, and calculations that underly DeFi lending and borrowing, yield aggregation, and pooling.

The Case for Crypto in an Institutional Portfolio. Bitwise Asset Management provides cryptocurrency index funds and made a name for itself its proposals for a bitcoin ETF and research into bitcoin prices. This report details the positive effects of adding 2.5% bitcoin to a 60/40 traditional portfolio even during bitcoin price downturns.

DeFi: Defining the Future of Finance. PwC, the accounting firm, provides a broader view of DeFi and its development. Not surprisingly, this report focuses on regulation, governance, and taxation. The report takes a European view and is published by the firm’s Hong Kong-based crypto team but given the nascent state of U.S. regulation, it provides a good introduction to these essential topics.