In a recent conversation on crypto and NFTs, the inevitable question came up: what’s this stuff worth? It’s a link on a blockchain, after all.

Yet NFTs are shaking up the art world, raising questions of artistic aesthetics and investment values. Artists can benefit both economically and legally.

I covered the economic and legal aspects of NFTs in How Misuse of a Technical Term Obscures an Economic and Legal Function.

I did not suggest in that post an alternative name for NFTs. The Chinese tech firms Tencent and Ant checked in this week with their alternative. Driven by the Chinese government’s crackdown on crypto, the two firms now refer to NFTs as “digital collectibles,” Bloomberg reports. It’s better than NFT but still too narrow, leaving out gaming and other entertainment industry uses of NFTs.

There are investment, aesthetic, and practical questions regarding NFTs that represent art. For one, Why would anyone want to own the NFT code when anyone can download a copy of the art anytime they want? For the same reason someone would want to own the original painting rather than the copy they can tear out of a magazine or a print they can buy at the museum store.

From that perspective, the NFT-as-art phenomenon is pretty simple to understand, and you already understand it, according to Jeff Dorman, chief investment officer at Arca, a digital asset investment firm. It may not be easy to “assign an appropriate value to any specific NFT, or that you won’t be stupefied by the astonishing price tag of some NFTs… but you do understand them. Scarcity, status quo, unique data, and entertainment have value,” he writes in the Tabb Forum.

The generic artistic category creating the most interest lately is “generative art,” a term with roots in the 1960s that refers to art made in whole or part by machines or algorithms. Like other past artistic movements, generative art represented and marketed as NFTs are shaking up the art world.

Select works from Tyler Hobbs’ Fidenza NFT generative art collection (Texas Monthly via Forbes)

“NFT generative art is a nascent and rapidly growing ecosystem within the crypto world that has emerged as an alternative to the absurdity of the traditional art world. Using a new artistic digitally native medium, the movement fundamentally challenges our conception of what gives art its value and how society expresses its communal values through art,” explains Forbes crypto-blockchain columnist Leeor Shimron in The NFT Generative Art Movement Is Challenging How We Think About Value.

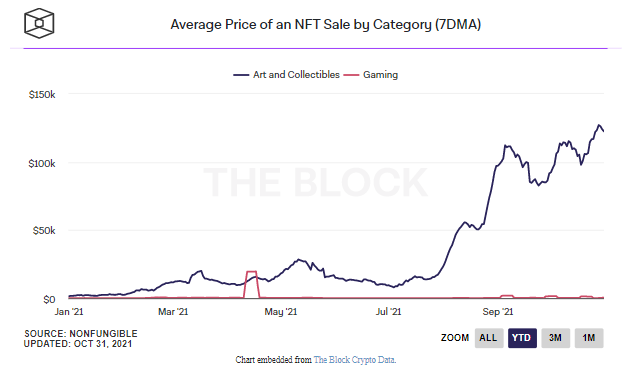

That’s debatable. What isn’t, however, is the prices investors are paying for NTF-based art, whether generative representations or unique digital creations. Prices for NFTs representing arts and collectibles are on a tear, taking off toward the end of July 2021.

On the question of value, my video-artist daughter is a bit more skeptical. “The whole phenomenon shakes up core assumptions about the nature of artistic creation and inspiration while simultaneously functioning as a pretty effective pyramid scheme,” she opines.

The serious art publications look at NFTs primarily from a traditionally aesthetic perspective. Digital creations should up their creative game if they want to be seen on par with the physical artwork in galleries and museums.

“Evidently, the challenges that come with making a successful PFP project hardly lie with the artistic process. Yet they’ve come to define the most sought-after assets on the NFT market,” writes Shanti Escalante-De Mattei in Art News. PFP stands for “profile pic,” pixel art series exemplified by the highly profitable CryptoPunks, Bored Apes, and Pudgy Penguins projects.

Some of these projects likely seek validation as “works of art,” but it’s a safe bet that most generative art created and sold as NFTs is designed solely to generate capital by appealing to investors. Their artistic value lies in how cool, cute, or charming they look – and how much investor attention they can attract.

Like many things crypto, there’s also a perceived rebel quality to NFT art. “The NFT generative art movement is leading to greater appreciation of art and inclusion on a global scale. The traditional art world has notoriously become an exclusive club and investment class for the ultra-wealthy to speculate on and flip for profit, or perhaps more nefariously, to launder money or engage in tax evasion,” writes Shimron.

I think that contributes to its value, but it’s clear to me that my daughter’s skepticism is not misplaced. The crypto art world functions in pretty much the same way as the traditional art world as far as I can see.

As I previously wrote, “The art market, like some alternative investments, is driven by the perception: beauty, exclusivity, scarcity, vanity. If people believe it’s valuable, then it is. Whether it holds value over time, well, that’s the bet a collector makes.”

Financial Times wealth columnist Stephen Foley has a theory on that point. “If there is one thing wealthy individuals and their advisors know about, it is art – and, this year, the worlds of cryptocurrency and art have collided in the form of NFTs.”

The questions of aesthetic and financial value aside, NFTs do not only benefit the artists that generate high profits for investors. Remember, NFTs as a general crypto construct, have both legal and economic functions that go beyond an investment asset class. An NFT certifies digital ownership.

Adobe recognizes that technical function and its limitations. Just because an NFT has been “minted” – the NFT art crowd uses the financial term for creation rather than the media term “published” – doesn’t mean it’s owned by the person who made the initial artistic creation. Adobe plans to add a new feature to Photoshop that will “fight NFT art theft.” The Content Credentials feature is designed to provide third-party certification of ownership, similar to an independent custodian or authentication of physical artwork. “Adobe’s system won’t prevent art theft, it does offer a way to prove that the NFT you’re selling isn’t stolen,” reports Mitchell Clark in The Verge.

For artists, the digital creations represented by an NFT also includes code that pays them a royalty whenever the creation is sold. They don’t receive that payment when a book, recording, or piece of art is resold.

NFTs also make it easier to split ownership of an expensive piece of art. Known as fractionalization, digital tokens representing shares of an asset – NFTs in this case – are sold to multiple buyers. (As an aside, “Democratization of finance” is a marketing value proposition used to describe fractional ownership whether it’s stocks, art, or something else.)

All told, Adobe’s chief product officer suggests that “This NFT world is likely the greatest unlock of artist opportunity in 100+ years. This isn’t a suboptimal or fringe version of the real-world art economy, it is a vastly improved one,” writes Scott Belsky, who founded Behance, a portfolio platform for graphic artists now owned by Adobe. NFTs also protect artists against counterfeiting. Belsky provides eight reasons why.