Addendum: This quote from 04/21/21 NY Times DealBook supports the general trend: "The public listing of Coinbase, the largest crypto exchange in the U.S., generated a wave of excitement that competitors aim to ride. Among them is Binance.US, the third-ranked domestic crypto exchange, which yesterday named Brian Brooks — formerly Coinbase’s chief counsel and most recently … [Read more...] about Follow the Money: The Institutional Rise of Crypto and FinTech

Navigating Startups from Seed to Series B

The allure of startups has rarely seemed stronger. Much of the tech industry is built on the backs of multi-billion dollar giants that came out of the startup space, and while tech appears to be in the middle of another bubble, the lure of relatively free-flowing investor money is hard to ignore. But what does it take to build a successful startup in this environment? Two … [Read more...] about Navigating Startups from Seed to Series B

China’s Digital Currency and CME’s Bitcoin Micro Contract

This week we feature a guest post from John Browning, founding partner of Hong Kong commodity and financial futures broker BANDS Financial. In reporting on the state of and statistics on the Chinese economy, Browning follows the development by the People's Bank of China (PBOC) of a so-called "digital yuan." We last wrote about it here. The PBOC's effort is gaining enough … [Read more...] about China’s Digital Currency and CME’s Bitcoin Micro Contract

Crypto’s Regulatory Imperative

For many FinTechs, particularly those operating in cutting-edge spaces like blockchain and cryptocurrency, regulation has often been seen as a dirty word; something that can only shackle innovation. But lack of regulation in the blockchain and crypto space has often served as a greater restriction than most actual laws can be, creating an air of uncertainty for companies … [Read more...] about Crypto’s Regulatory Imperative

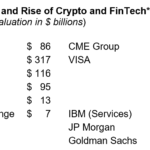

Banking on FinTech

U.S. banks made more than 65 strategic bets in FinTech in 2020. Capital markets investments led the way. “Despite the economic uncertainty surrounding the Covid-19 pandemic, U.S. banks are future-proofing by actively investing in FinTech,” research firm CBInsights concludes in a report released last week. Deals in the capital markets category more than doubled those in the … [Read more...] about Banking on FinTech

March 2021: The Month in FinTech

The month of March started with an international focus that included our most popular article of the month, as measured by page views. As a whole, however, bitcoin and digital assets dominated the news and our themes of the week. Here's a review. Innovation and Regulation: Building Better International Payments International trade and commerce are a major piece of … [Read more...] about March 2021: The Month in FinTech