This year’s Money20/20 conference showed a maturing FinTech industry, with a focus as much on the how and why of financial technologies as on the what and the new. Crypto and blockchain weren’t as evident as they’ve been in the past while AI and machine learning discussions focused more on how to make impersonal technology processes at least seem more human, with more … [Read more...] about FinTech Matures

Adding Human Values to Automated Systems

What we in marketing call “personalization” isn’t always personal. Products and services may be suggested based on a customer’s past—and personal—purchasing. And that can and certainly does lead to another purchase—or what we call a “conversion.” Conversions, however, are not personal. Conversations are. Conversions transact; conversations connect. Yet in the grand scheme … [Read more...] about Adding Human Values to Automated Systems

Featured Client Content

Recent work for Canright clients features technology-supported investment strategies, software development techniques, and data-connection services. BYLINED ARTICLES How AI Technologies Can Put Purpose and Profit into ESG Investments http://bit.ly/CanrightPurposeProfit ESG Screening: The Case for AI and Alternative Data http://bit.ly/CanrightYewnoESGScreening POINT OF … [Read more...] about Featured Client Content

Retail Payments at the Point of Sale

This is what retail payments at the point of sale really look like: … [Read more...] about Retail Payments at the Point of Sale

Consumer Design and Data: Notes from Money20/20

During a typically busy Money20/20 day of running from one meeting to another, I had a chance to listen to several presentations concerning customer experience and how to use technology and data to make it great. Both are significant challenges to all businesses, but especially financial institutions of all sizes. The experience of financial services customers and how to … [Read more...] about Consumer Design and Data: Notes from Money20/20

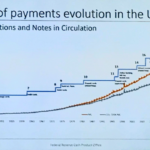

Making Money Move Faster in the United States

Moving money faster remains a persistent challenge in the United States. Consumers continue their wary adoption of mobile payments; cards remain the primary payment method of choice at the point of sale, and cash in circulation continues to grow faster than U.S. gross domestic product. Corporations, for their part, still prefer checks. The situation is changing, and it’s a … [Read more...] about Making Money Move Faster in the United States