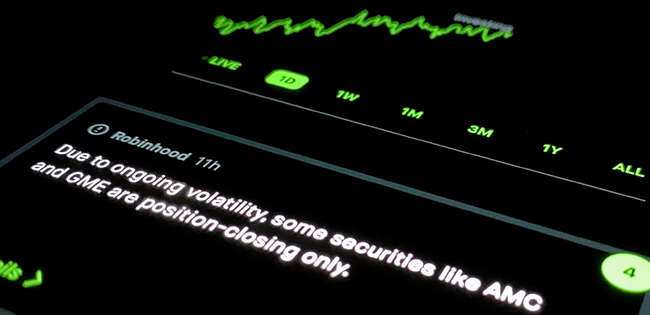

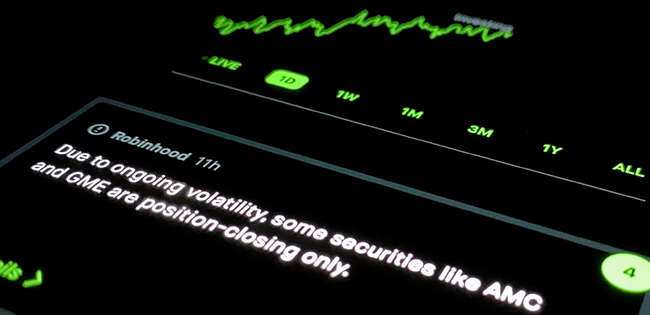

It would be difficult to follow financial news and miss this week’s saga of the GameStop trade and the role played by the Robinhood trading app. The narrative threads include comparisons to the Occupy Wall Street populist movement and of course a conspiracy theory involving hedge funds. Variations on that story may land the founder of the Citadel Securities, the market maker that pays Robinhood for dealflow, in front of the inevitable Congressional inquiries.

The number of possible stories that can be told about the financial and market mechanics gave Bloomberg’s Money Stuff columnist Matt Levine a full week of stories. It’s rare that one trade can highlight so many social, technological, market, and economic dynamics in the space of one week. Let’s hope it becomes a cautionary tale or capital allocation or a comedy about gambling fueled by boredom and trading apps and not a tragedy in the making. The last time a trade got such attention, the wrap-up book was titled The Big Short.