Buy now, pay later (BNPL) techniques have caught the attention of credit-card issuers, as the new lenders cut into bank-card profits. Online lending by FinTech firms in general is also on the rise, reports The Financial Brand.

“Fintechs have been snatching up market shares left and right from traditional banks and credit unions. Fintechs claimed 49.4% of the unsecured personal loan market in March 2019, up from 22.4% four years before,” according to Experian in a 2019 report. The percentage may well be higher, especially because BNPL lenders would not have been counted in that report.

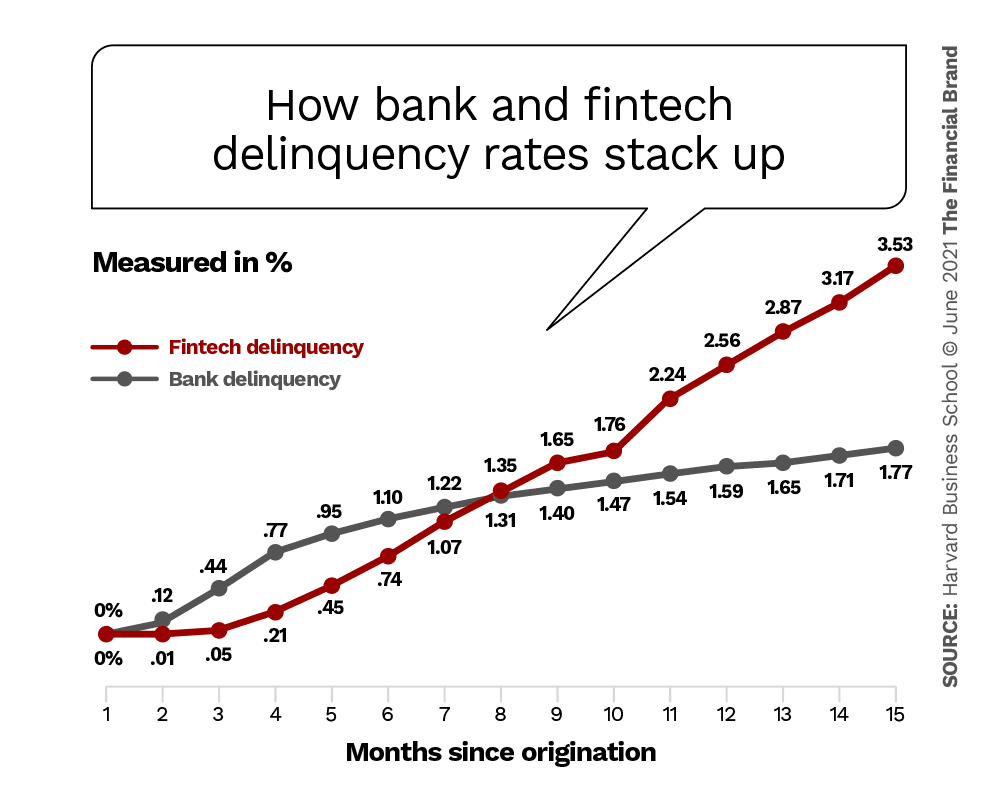

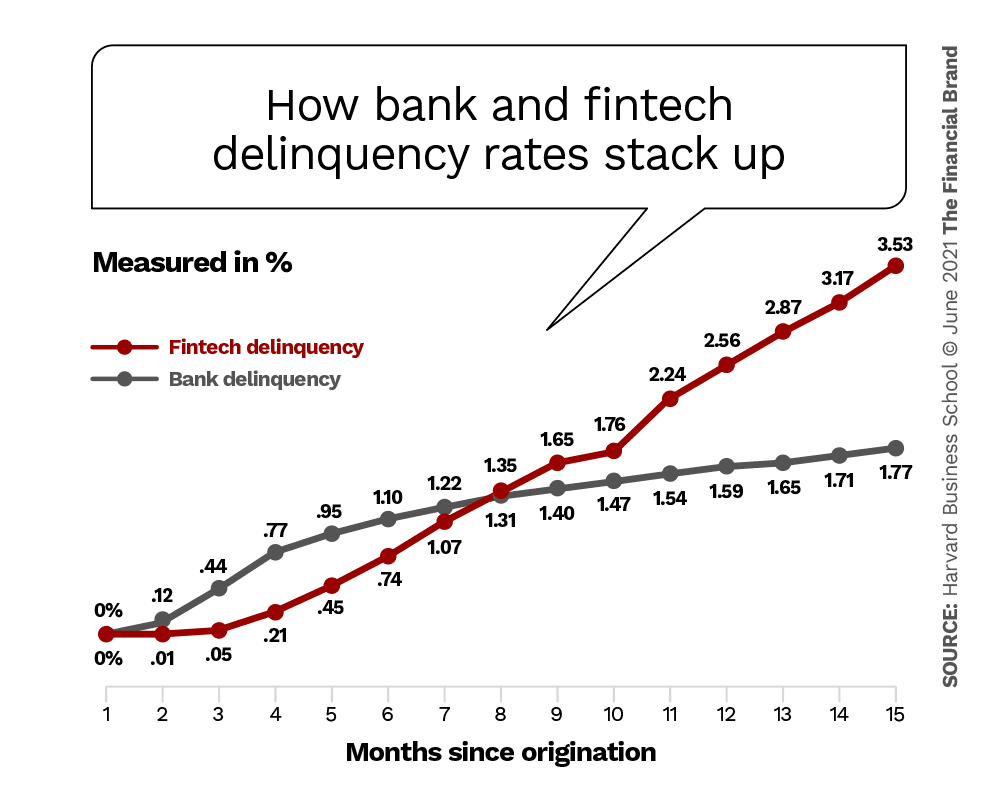

At the same time, FinTech loans have higher delinquency rates, according to a Harvard Business Review study Fintech Borrowers: Lax-Screening or Cream-Skimming? “The level of delinquencies is much higher on these non-traditional loans,” The Financial Brand article states. The Harvard study shows that delinquency rates are nearly twice as high for nontraditional lenders.

“Most of the fintech borrowers have credit scores in the mid-range between 640 and 720. They tend to have a higher number of accounts and exhibit a higher credit utilization ratio, which suggests that they already have plenty of access to credit, and that one of the potential reasons to apply for a fintech loan is to consolidate higher-rate credit card debts,” the Harvard study notes. The study was originally published in 2018 and updated in October 2020.

What’s bad for banks can be good for consumers and for FinTechs. FinTech lending rates are much higher than bank lending rates in accord with the higher risk. Consumers have a chance to build their credit scores – as long as they understand the credit terms and the financial risk.

Most important, however, is the need for consumers to understand how to use high-cost loans to achieve greater financial wellness. Several online lenders have designed their services to provide consumers build a path to better credit, including Chicago-based OppLoans and Braviant.

Credit management is only part of the equation. The Chicago Payments Forum recently hosted two firms focused on helping consumers increase their financial health and security through difficult times, including the covid-19 pandemic. Listen to the discussion to learn how SpringFour and Canary help consumers times of financial need.