The political jockeying for regulatory positions on digital asserts continued this week. The head of the Commodities Futures Trading Commission let the Securities Exchange Commission know that only the CFTC could regulate crypto. The Biden administration fought cuts of provisions to regulate cryptocurrencies in the infrastructure bill.

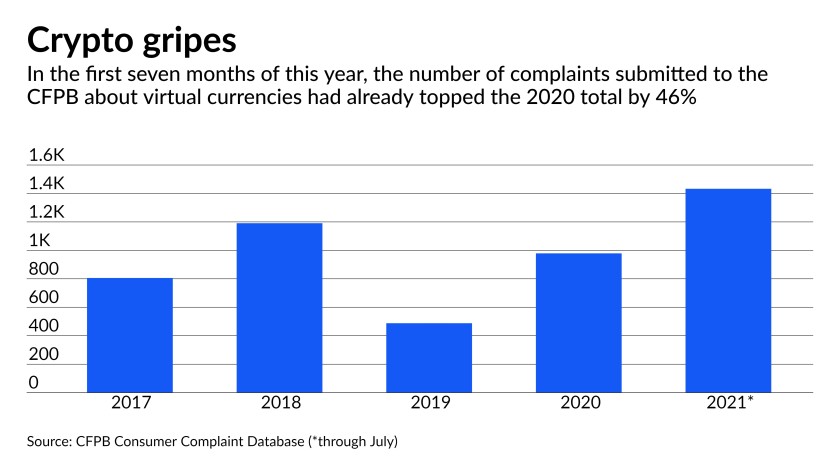

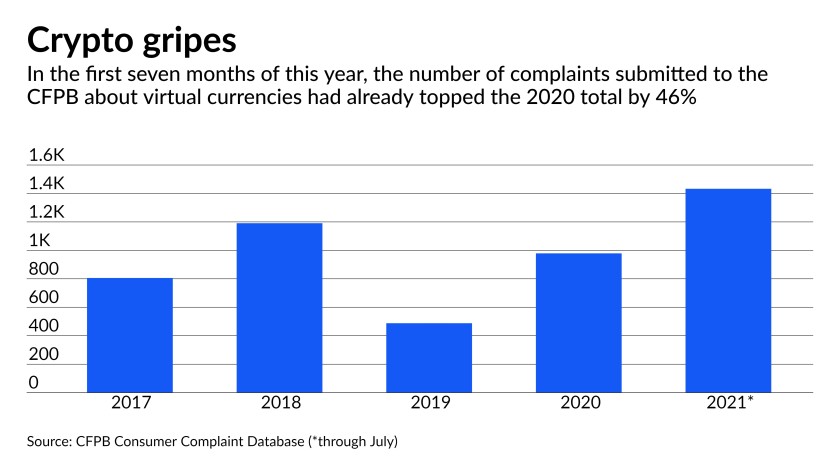

Meanwhile, American Banker wonders whether a Consumer Finance Protection Bureau crypto crackdown is imminent as complaints soar.

At the same time, the Federal Reserve continues its debates over the value of issuing a digital dollar. With cryptocurrency tokens pegged to the U.S. dollar, stablecoins, “the private sector is already developing payment alternatives to compete with the banking system. Hence, it seems unnecessary for the Federal Reserve to create a CBDC to drive down payment rents,” Governor Christopher J. Waller told the American Enterprise Institute.

Policymakers and regulators smell tax revenue and regulatory territory. The future of digital assets is assured.