U.S. financial regulators are calling for stablecoin regulation with representatives of the nation’s primary regulatory offices making the rounds of Congress and the financial media over the past two weeks.

That stablecoins, cryptotokens backed by national currency or other fixed assets, pose risks and should be regulated is not the primary question. It’s which office has authority to write the rules over which stablecoin use cases.

U.S. Treasury Secretary Janet Yellen convened a working group to examine stable coins “to assess the potential benefits of stablecoins while mitigating risks they could pose to users, markets, or the financial system.” The group met early this week and issued a short post-meeting release.

Yellen “underscored the need to act quickly to ensure there is an appropriate U.S. regulatory framework in place,” according to the release. The rest of the release listed the names of the primary officials who attended from the main regulatory U.S. financial regulatory offices.

In a keynote address to the American Bar Association just after the meeting, Securities and Exchange Chairman Gary Gensler notes that stablecoins backed by securities should be regulated by the SEC. “Global synthetic securities have been a popular application of crypto technology, allowing global users to access otherwise off-limits investments, especially those in the United States,” reports The Block.

Earlier in the month, Federal Reserve Chairman Jerome Powell made headlines by telling Congress that stablecoins needed better oversight. “If we’re going to have something that looks just like a money-market fund, or a bank deposit, a narrow bank, and it’s growing really fast, we really ought to have appropriate regulation — and today we don’t,” he said during testimony before the Senate Banking Committee.

Stablecoins are digital assets designed to have a stable value, in contrast to the volatile prices swings of bitcoin and many other cryptocurrencies. By pegging a digital token to a national currency or other fixed assets, the token’s value does not fluctuate. Investors rely on that stable value to more easily move in and out of other crypto assets investments. Learn more in Blockworks’s series of educational articles, The Investor’s Guide to Stablecoins.

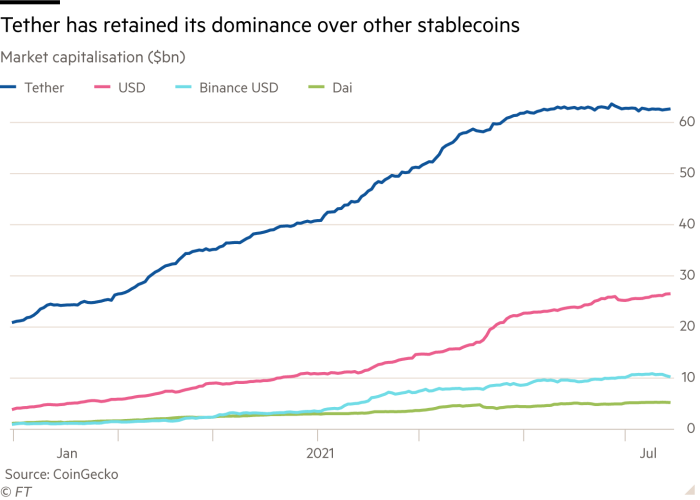

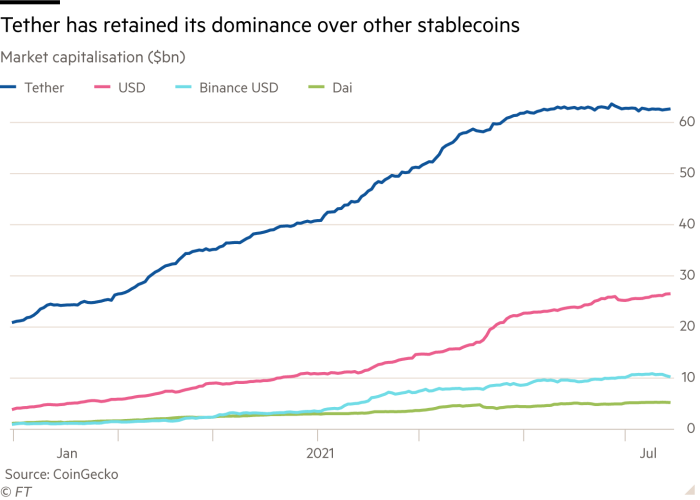

Much of the regulatory concern has stemmed lately from Tether, the largest and most controversial stablecoin. Tether is reportedly backed by the U.S. dollar, but how and how much is difficult to tell. The New York Attorney General’s Office sued the Tether organization, forcing more transparency in the assets that back the crypto.

Yet Bloomberg has been unable to verify the sources of the commercial paper Tether lists as backing assets. “That’s pretty stunning, since back-of-the-envelope math suggests Tether bought the equivalent of 1% of the entire market in April alone,” Katherine Greifeld reports.

It gets worse. The Financial Times details Tether’s lack of transparency and potential risks in a lengthy article, “Tether: the former plastic surgeon behind the crypto reserve currency.” Tether’s CTO and general counsel did an interview with CNBC’s Deirdre Bosa during which they did little to create more certainty: Tether is the leading stablecoin, and the market has spoken. That’s all you need to know. “Everything in this interview melted my brain,” commented Bloomberg’s Matt Levine.

Drama aside, stablecoins provide a way of moving from digital assets back into traditional financial assets and from one digital asset into another, without the problems of value fluctuation. “I think they are a very important part of the crypto asset landscape,” wrote venture capitalist Fred Wilson. “You hold them like cash, to be able to move in and out of trades, purchase things, etc.”

In other testimony, Powell spoke up for the Fed’s discussions for developing a digital dollar, a token that would fall into the class of central bank digital currencies (CBDCs). “You wouldn’t need stablecoins, you wouldn’t need cryptocurrencies, if you had a digital US currency,” he said. “I think that’s one of the stronger arguments in its favor.”

For his part, Wilson believes that private stablecoins provide competition that leads to innovation. “When you have a monopoly, like the U.S. Government or any government, pushing out the alternatives and forcing us to use their digital dollar, you lose all the value of competition. And that would be a terrible thing.”

SEC Commissioner Hester Peirce walks a fine line between Powell and Wilson, saying in an interview with Coindesk that “in some sense stablecoins are a more exciting option than a central bank digital currency.”

The risk point, she noted, is where crypo finance intersects with traditional finance and crypto assets are exchanged with fiat currencies. “There is an awakening in D.C. now realizing that crypto is here to stay,” Peirce said. “We have to think clearly about how to regulate it.”

Dan Berkovitz, commissioner at the U.S. Commodity Futures Trading Commission (CFTC), is optimistic in that regard.