Selling the concept of faster payments, in many of the myriad forms they can take, isn’t difficult. Most of the industry players agree it’s overdue: the U.S. hasn’t had a new payments structure in over 40 years. Needless to say, achieving it is a huge undertaking; not only in building the technology but also in getting large-scale adoption, as it requires buy-in from every single stakeholder in the industry.

As little as a few years ago, plans to incorporate these new technologies were still largely theoretical in the U.S. But today, it appears to be a journey that many are preparing to undertake, according to the 2020 Faster Payments Barometer, an industry survey conducted by the US Faster Payments Council in cooperation with payments consultancy Glenbrook Partners.

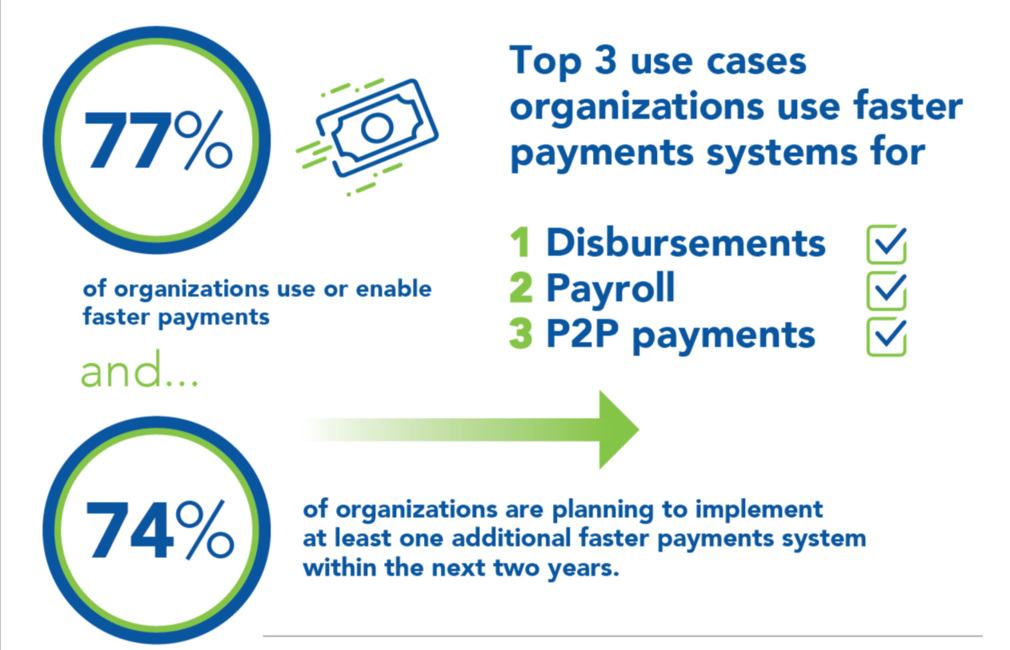

“Seventy-seven percent of organizations that did the survey use, or plan to enable, a faster payments solution,” said Beth Horowitz Steel, a payments executive and partner at Glenbrook Partners. “Of those, 73% plan on implementing one in the next few years. When we took this survey last year, this wasn’t even a question we asked – things were too nascent – but now you have a fair number of people in the industry saying they’re moving forward.”

Results show that the pandemic has not, for a majority of respondents, slowed this shift. If anything, for some, implementation strategies, shifts toward faster payments are only accelerating. One of the factors that may be driving this rapidly coalescing consensus on real action is an increasing alignment on use cases.

The top three use cases, broadly agreed upon by respondents, are all practical and already seeing real-world use – and, in many cases, are clearly built to address issues that a year largely spent in lockdown has exacerbated.

- Peer-to-Peer (P2P). In a world where banks aren’t just competing with other banks, but with Venmo and Paypal, laying the foundation of moving money quickly between individuals is consistently a strong consumer demand.

- Disbursements. Covid has made improvements in this area critically important – especially with another round of stimulus checks from the federal government in the offing. The last round of checks put on display glaring problems in this area under the existing payments system – and it was a weakness that the prepaid industry, among others, fully took advantage of.

- Payroll. The notion of being paid wages for work you’ve done same-day is expanding beyond an expectation of Uber drivers. Big corporations are beginning to study the feasibility of this issue to meet the needs of their employees.

Even with planning moving into the real work of implementation, however, it’s still going to take time before faster payments become a standard reality across most of the industry.

“The adoption of systems used by surveyed participants follows the cadence of how long those systems have been in the market,” Steel said. “RTP is still behind Same-Day ACH, and lower than Zelle. But you see it differently when you look at systems they’re planning to implement.”

What the data largely points to is the reality of a commercially-driven adoption curve. It’s a trickle-down effect and one that will likely have to hit a tipping point in terms of ubiquity before adoption becomes truly widespread.

One elephant in the room is, of course, the Federal Reserve. Plans for FedNow continue, but with the faster payments rail still several years away from implementation, some stakeholders have felt the incentive of waiting on it to arrive before moving beyond planning into the serious investments that will be required to make new technologies work.

“We’re crawling right now with faster payments,” said Peter Tapling, Managing Director of PTap Advisory, LLC and board member with the US Faster Payments Council. “I’m hopeful into 2021 to 2022 we’re walking with pretty great speed, and the users of payments – people like you and me and hospitals and other companies begin to upgrade their systems. It’s on us as an industry to take all of this new tech and figure out the ways to make it as painless as possible for the users.”

Steele presented the findings at the December meeting of the Chicago Payments Forum.