Buy Now, Pay Later has finished 2021 strong, the new payment model seeing strong adoption over the past 12 months particularly as the pandemic forced a number of shifts to consumer spending habits. The biggest platforms continue to expand – BNPL company Klarna recently extended its services to incorporate all online retailers, whether they’re Klarna partners or not – but while … [Read more...] about BNPL: High Reward, High Risk?

Lending

FinTechs Led in PPP Fraud, UT Study Shows

Paycheck Protection Program (PPP) loans presented trouble for FinTech lenders, a University of Texas study released Tuesday showed. The study, which examined more than 10 million loans for potential red flags, showed 9 out of 10 of the highest rates of suspicious loans being approved by FinTechs. To some extent, this dubious distinction makes some sense; more than 70% of all … [Read more...] about FinTechs Led in PPP Fraud, UT Study Shows

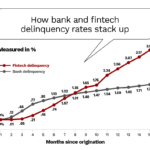

The Darker Side of FinTech Lending

Buy now, pay later (BNPL) techniques have caught the attention of credit-card issuers, as the new lenders cut into bank-card profits. Online lending by FinTech firms in general is also on the rise, reports The Financial Brand. “Fintechs have been snatching up market shares left and right from traditional banks and credit unions. Fintechs claimed 49.4% of the unsecured … [Read more...] about The Darker Side of FinTech Lending

Buy Now Pay Later – A More Level Playing Field for Lending?

Buy now, pay later. It’s a simple and evocative term for a growing financial service that offers precisely what the name suggests – the ability to buy something without having to pay for it till a later date. Unlike revolving credit, the main sales pitch for the scheme is that if you make your payments on time, you do so with zero interest and zero additional processing … [Read more...] about Buy Now Pay Later – A More Level Playing Field for Lending?

Continuing the Growth of Cannabis Banking

Recreational marijuana is now legal in 16 states - with medical usage legal in 36. It's now a thriving billion-dollar industry in those states -- but it remains in an uncertain position, heavily reliant on cash and with uncertain prospects for banking partners due to the continued federal prohibition. The challenges are more difficult than some industries, to be sure; due to … [Read more...] about Continuing the Growth of Cannabis Banking

An Approaching Crisis in Consumer Lending

The past year’s been tumultuous for consumer loans – while almost every sector of the economy has been impacted in some way, federal moratoria on foreclosures and evictions in combination with mortgage forbearances have put a huge piece of consumer loan servicing on an indefinite hold, as deadlines have shifted from initial positions at the end of February to the end of June, … [Read more...] about An Approaching Crisis in Consumer Lending