The Federal Reserve recently released a white paper sharing insights on combating the risk of synthetic identity fraud. As we noted in an earlier article on the subject, this type of fraud is particularly difficult for traditional detection methods to flag, and it represents the fastest-growing type of financial crime in the United States. It’s a problem uniquely built for … [Read more...] about Addressing the Challenges of Synthetic Identity Fraud

Lending

Alternative Lenders Fill the Gap, But Must Be Careful

Already fulfilling the basic financing needs of small businesses, alternative lenders may help fill the gap in getting Payroll Protection Plan (PPP) money to small businesses. Since the program opened and ran out of money, nonbank lenders got approval to provide PPP loans. I had emails in my inbox from Ondeck (I'm a customer), Square Capital, and PayPal. This indicates an … [Read more...] about Alternative Lenders Fill the Gap, But Must Be Careful

FinTech Platforms Emerge in Wealth Management

Software companies are seeking to use the “platform” model to extend their reach and help segments of the wealth management industry use technology to retain clients and expand market share. “It is well established that when software platforms enter into any market, they virtually always win, and they win big,” said Lawrence Johnson, SVP and Head of Fintech Engagement for … [Read more...] about FinTech Platforms Emerge in Wealth Management

Could the Crypto Market Protect Against a New Global Recession?

Note: Since this was published, the repo markets have not improved; the Fed supplied another $205 billion to the market on October 18. See James Bianco's LinkedIn post for more at: http://bit.ly/35MM8QJ The Federal Reserve has extended its recent interventions into the securities repurchase, or “repo” market, into November. It’s the first time that the Fed’s intervened in … [Read more...] about Could the Crypto Market Protect Against a New Global Recession?

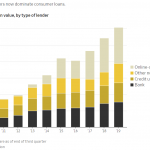

Lending Gaps and Lessons

THE WEEK IN FINTECH v3.22 The gap in small business lending, which the easy-money policies of the Federal Reserve were supposed to fill, are well documented. It's more difficult for small businesses to get small loans from banks, in large part because it's less profitable for banks of all sizes to make small-dollar loans. A Harvard Business School report on the state of … [Read more...] about Lending Gaps and Lessons

Online Lending Collaboration

How INTRUST Bank collaborates with Funding Circle Banks can collaborate with FinTech and other firms in a wide variety of ways. INTRUST Bank is looking toward a shared purpose and vision to make a long-term collaboration work for everyone. “We are looking for partners with like-minded philosophies, not just in terms of how to underwrite, but in terms of mission and vision … [Read more...] about Online Lending Collaboration