This week, we dive into the Federal Reserve’s 2023 Diary of Consumer Payment Choice, highlighting the continued dominance of credit cards and the stabilization of cash usage. Additionally, we cover Apple’s concessions in the EU Tap-to-Pay dispute, growth in both U.S. realtime payments networks, and new guidelines from China on payment services for foreigners, and more insights into the business of digital wallets.

2023 Findings from the Diary of Consumer Payment Choice

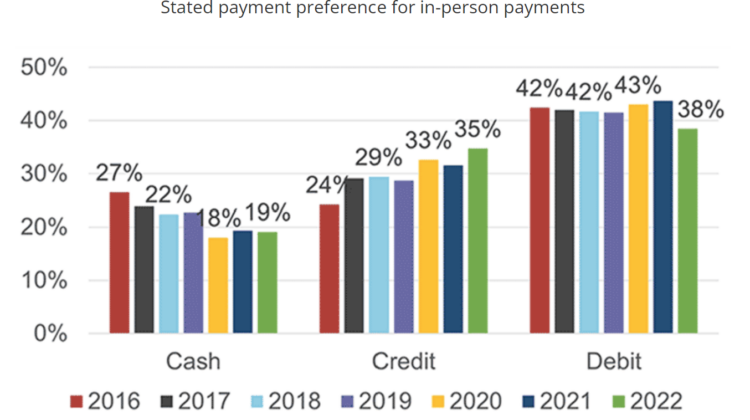

Findings from the Federal Reserve’s 2023 Diary of Consumer Payment Choice reveal that debit cards remain the most popular payment method, continuing a trend that began during the pandemic. Cash usage has stabilized but remains lower than pre-pandemic levels, with consumers holding more cash on hand. The survey also shows a steady use of debit cards and a leveling off of mobile app payments. Interestingly, the data indicates that while digital payments are prevalent, people still prefer cash for small transactions.

Apple Accepts More Concessions to Settle the EU Tap-to-Pay Dispute

Apple made concessions to the European Commission in its tap-to-pay dispute, allowing third-party digital wallets access to the iPhone’s NFC technology, reports PaymentsJournal. Apple will now allow third-party wallet providers to access this technology, enabling more innovation and choice for users. These commitments, effective for ten years, aim to ensure fair competition and will be closely monitored by a trustee. This move is expected to further boost the use of digital wallets and contactless payments.

The Business of Wallets

Bits About Money explores the evolution and business model of digital wallets, highlighting their shift from physical to electronic formats. It delves into how companies like PayPal and Cash App make money by managing transactions and balances within their ecosystems. The article also touches on the regulatory complexities and the impact of mobile wallets like Apple Pay and Google Wallet in the financial technology space.

Realtime Payments See Growth Spurt in the U.S.

The Clearing House’s RTP Network had its first $1 billion dollar day in June and saw substantial growth this year, reports Digital Transactions. The network processed 82 million transactions worth $55 billion in Q2 2024, up from 57 million transactions worth $29 billion the previous year. RTP now includes 652 banks and credit unions, with over 250,000 businesses and 5 million consumers using the service monthly. Meanwhile, the Federal Reserve’s FedNow Service celebrates its first year, highlighting rapid adoption in real-time payments, with 33% of banks offering the service and 43% planning to, reports American Banker.

China Unveils Guidelines on Optimized Payment Services for Foreigners

China unveils new guidelines to streamline payment services for foreigners, reports China Briefing, making it easier to use mobile payments, bank cards, and cash. The People’s Bank of China aims to address previous barriers by promoting the acceptance of international cards, easing mobile payment requirements, and ensuring widespread cash acceptance. This initiative is expected to enhance convenience for foreign visitors and boost tourism and international business interactions.

That’s a wrap for this week’s Fintech Rising Weekly newsletter! We hope you enjoyed our deep dive into the latest trends and insights, from the enduring popularity of credit cards to the impressive growth of FedNow’s real-time payments network. With Apple’s new commitments in the EU and China’s updated guidelines for foreigner payment services, it’s clear that the landscape of digital payments is evolving rapidly. Thanks for tuning in, and we’ll see you next week with more FinTech trends.