Who can easily take advantage of the benefits of digital financial services and who cannot? Taken together, this list of articles and research papers shows that cash is no longer king. They also suggest increasing income inequality. The ticket to the digital economy and its efficiencies and rewards is a bank account. Bridging the gap between cash and digital has policy … [Read more...] about Crypto Investments and Faster Payments Meet the Unbanked and Unequal

faster payments

Building Faster Payments: From Conception to Reality

Selling the concept of faster payments, in many of the myriad forms they can take, isn’t difficult. Most of the industry players agree it’s overdue: the U.S. hasn’t had a new payments structure in over 40 years. Needless to say, achieving it is a huge undertaking; not only in building the technology but also in getting large-scale adoption, as it requires buy-in from every … [Read more...] about Building Faster Payments: From Conception to Reality

Digital Payments and Currencies in China. They’re Faster.

The following is a guest post from John Browning, founding partner of Hong Kong commodity and financial futures broker BANDS Financial. In reporting on the state of and statistics on the Chinese economy, Browning follows the development of a digital currency by China's central bank. See our post Constructing the Future of Money for an introduction. This post, an excerpt from … [Read more...] about Digital Payments and Currencies in China. They’re Faster.

Bridging the Gap to Faster Payments

The vision for a robust faster payments ecosystem in the United States is well-established. There are multiple contenders to bring it to life – from private offerings like The Clearing House (TCH) to the Federal Reserve’s continuing efforts into FedNow – but achieving true ubiquity can seem like an elusive target. How is that gap from vision to reality going to be … [Read more...] about Bridging the Gap to Faster Payments

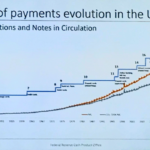

Making Money Move Faster in the United States

Moving money faster remains a persistent challenge in the United States. Consumers continue their wary adoption of mobile payments; cards remain the primary payment method of choice at the point of sale, and cash in circulation continues to grow faster than U.S. gross domestic product. Corporations, for their part, still prefer checks. The situation is changing, and it’s a … [Read more...] about Making Money Move Faster in the United States

U.S. Faster Payments Present and Future

Everyone wants to get paid faster. As faster payments systems come online from central banks around the world, the United States lags with an aging, efficient, and relatively slow payments infrastructure. That's changing as consumers come to expect payments to work as immediately as commerce in general. The Chicago Payments Forum hosted two startups providing solutions for … [Read more...] about U.S. Faster Payments Present and Future