Buy Now, Pay Later has finished 2021 strong, the new payment model seeing strong adoption over the past 12 months particularly as the pandemic forced a number of shifts to consumer spending habits. The biggest platforms continue to expand – BNPL company Klarna recently extended its services to incorporate all online retailers, whether they’re Klarna partners or not – but while … [Read more...] about BNPL: High Reward, High Risk?

lending

FinTechs Led in PPP Fraud, UT Study Shows

Paycheck Protection Program (PPP) loans presented trouble for FinTech lenders, a University of Texas study released Tuesday showed. The study, which examined more than 10 million loans for potential red flags, showed 9 out of 10 of the highest rates of suspicious loans being approved by FinTechs. To some extent, this dubious distinction makes some sense; more than 70% of all … [Read more...] about FinTechs Led in PPP Fraud, UT Study Shows

Buy Now Pay Later – A More Level Playing Field for Lending?

Buy now, pay later. It’s a simple and evocative term for a growing financial service that offers precisely what the name suggests – the ability to buy something without having to pay for it till a later date. Unlike revolving credit, the main sales pitch for the scheme is that if you make your payments on time, you do so with zero interest and zero additional processing … [Read more...] about Buy Now Pay Later – A More Level Playing Field for Lending?

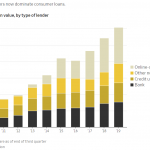

An Approaching Crisis in Consumer Lending

The past year’s been tumultuous for consumer loans – while almost every sector of the economy has been impacted in some way, federal moratoria on foreclosures and evictions in combination with mortgage forbearances have put a huge piece of consumer loan servicing on an indefinite hold, as deadlines have shifted from initial positions at the end of February to the end of June, … [Read more...] about An Approaching Crisis in Consumer Lending

Addressing the Challenges of Synthetic Identity Fraud

The Federal Reserve recently released a white paper sharing insights on combating the risk of synthetic identity fraud. As we noted in an earlier article on the subject, this type of fraud is particularly difficult for traditional detection methods to flag, and it represents the fastest-growing type of financial crime in the United States. It’s a problem uniquely built for … [Read more...] about Addressing the Challenges of Synthetic Identity Fraud

Alternative Lenders Fill the Gap, But Must Be Careful

Already fulfilling the basic financing needs of small businesses, alternative lenders may help fill the gap in getting Payroll Protection Plan (PPP) money to small businesses. Since the program opened and ran out of money, nonbank lenders got approval to provide PPP loans. I had emails in my inbox from Ondeck (I'm a customer), Square Capital, and PayPal. This indicates an … [Read more...] about Alternative Lenders Fill the Gap, But Must Be Careful